Summary

We consider the problem of finding a real valued martingale fitting specified marginal distributions. For this to be possible, the marginals must be increasing in the convex order and have constant mean. We show that, under the extra condition that they are weakly continuous, the marginals can always be fitted in a unique way by a martingale which lies in a particular class of strong Markov processes. It is also shown that the map that this gives from the sets of marginal distributions to the martingale measures is continuous. Furthermore, we prove that it is the unique continuous method of fitting martingale measures to the marginal distributions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

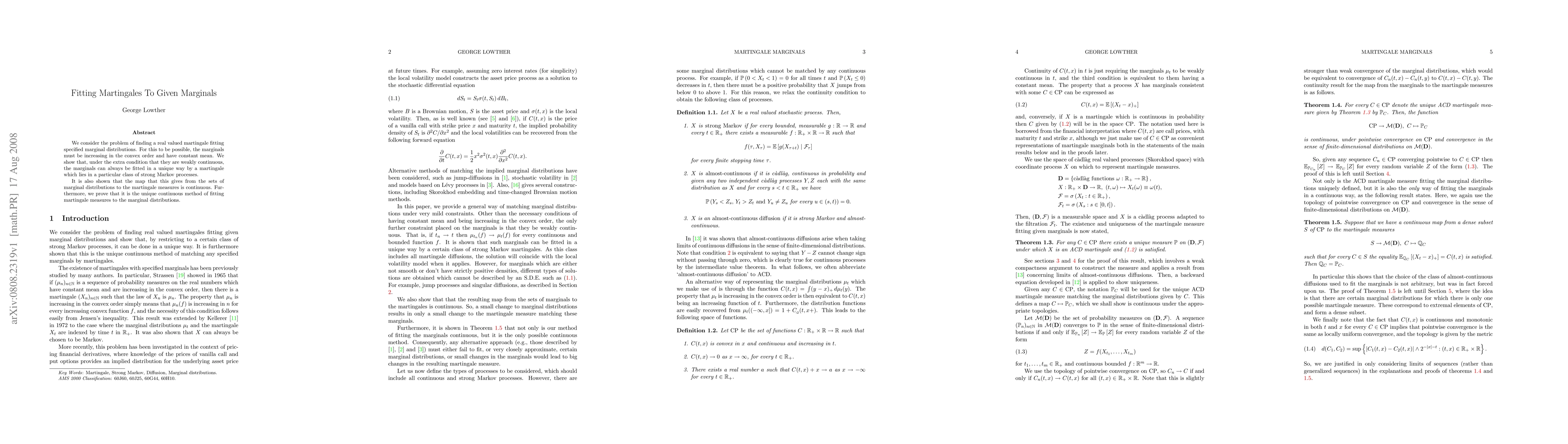

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)