Summary

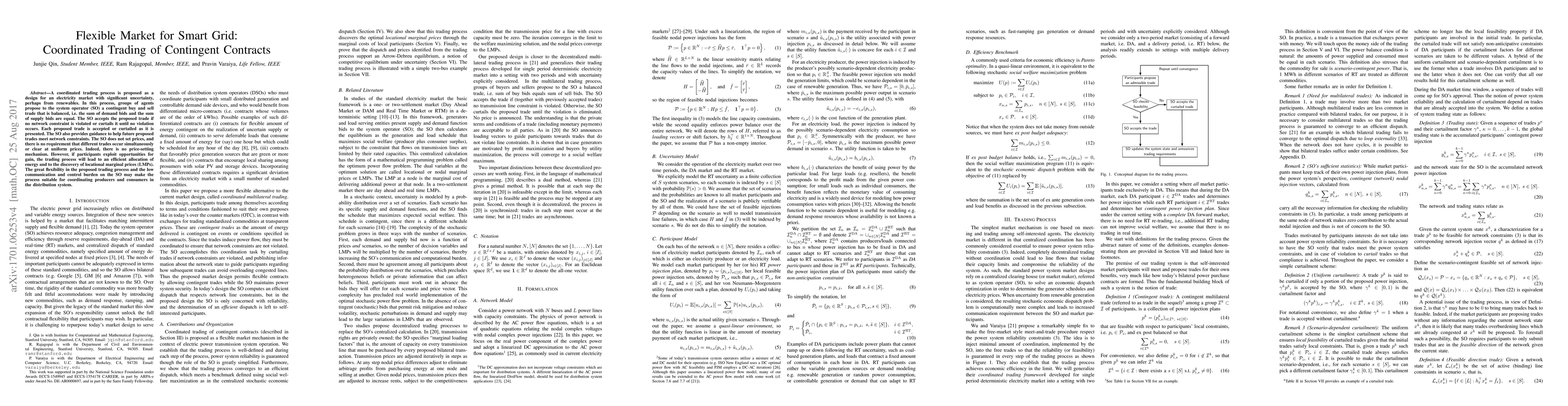

A coordinated trading process is proposed as a design for an electricity market with significant uncertainty, perhaps from renewables. In this process, groups of agents propose to the system operator (SO) a contingent buy and sell trade that is balanced, i.e. the sum of demand bids and the sum of supply bids are equal. The SO accepts the proposed trade if no network constraint is violated or curtails it until no violation occurs. Each proposed trade is accepted or curtailed as it is presented. The SO also provides guidance to help future proposed trades meet network constraints. The SO does not set prices, and there is no requirement that different trades occur simultaneously or clear at uniform prices. Indeed, there is no price-setting mechanism. However, if participants exploit opportunities for gain, the trading process will lead to an efficient allocation of energy and to the discovery of locational marginal prices (LMPs). The great flexibility in the proposed trading process and the low communication and control burden on the SO may make the process suitable for coordinating producers and consumers in the distribution system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNewly Developed Flexible Grid Trading Model Combined ANN and SSO algorithm

Wei-Chang Yeh, Yu-Hsin Hsieh, Chia-Ling Huang

Dynamic Grid Trading Strategy: From Zero Expectation to Market Outperformance

Jyh-Shing Roger Jang, Kai-Hsin Chen, Kai-Yuan Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)