Summary

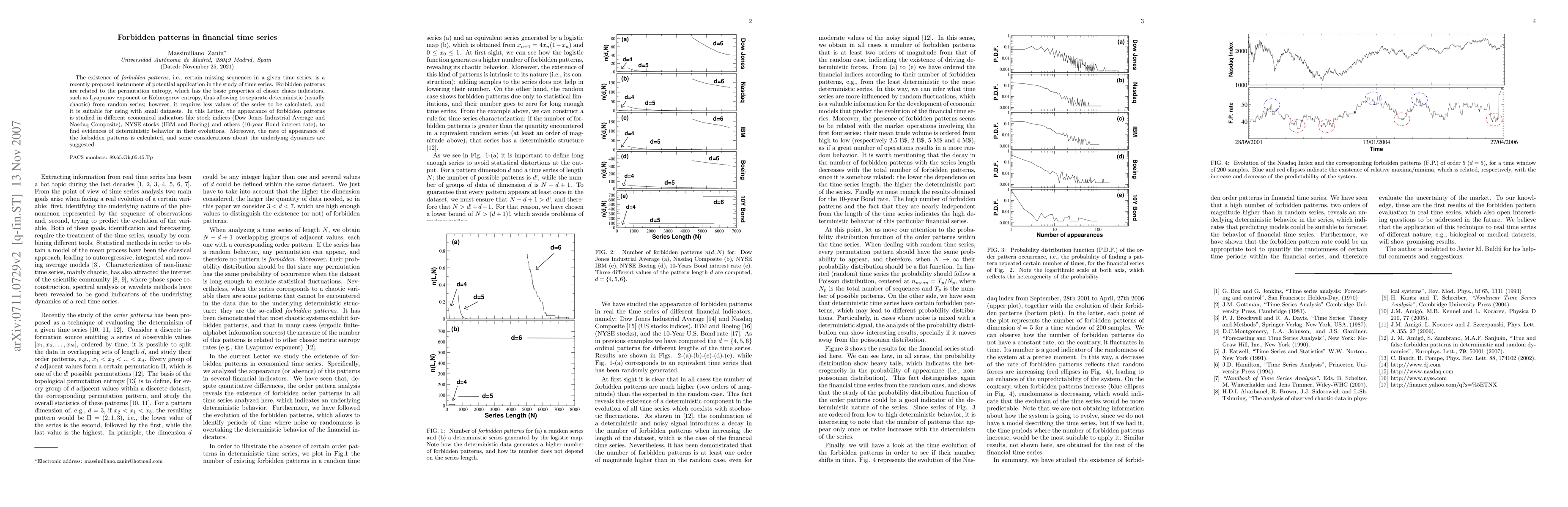

The existence of forbidden patterns, i.e., certain missing sequences in a given time series, is a recently proposed instrument of potential application in the study of time series. Forbidden patterns are related to the permutation entropy, which has the basic properties of classic chaos indicators, thus allowing to separate deterministic (usually chaotic) from random series; however, it requires less values of the series to be calculated, and it is suitable for using with small datasets. In this Letter, the appearance of forbidden patterns is studied in different economical indicators like stock indices (Dow Jones Industrial Average and Nasdaq Composite), NYSE stocks (IBM and Boeing) and others (10-year Bond interest rate), to find evidences of deterministic behavior in their evolutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFew-Shot Learning Patterns in Financial Time-Series for Trend-Following Strategies

Stefan Zohren, Kieran Wood, Samuel Kessler et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)