Summary

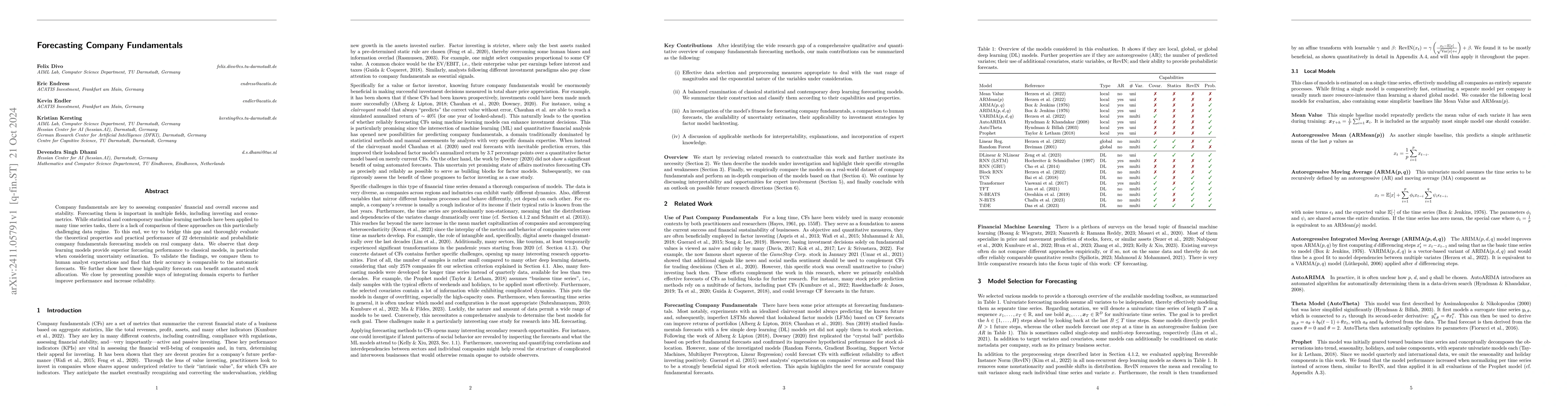

Company fundamentals are key to assessing companies' financial and overall success and stability. Forecasting them is important in multiple fields, including investing and econometrics. While statistical and contemporary machine learning methods have been applied to many time series tasks, there is a lack of comparison of these approaches on this particularly challenging data regime. To this end, we try to bridge this gap and thoroughly evaluate the theoretical properties and practical performance of 22 deterministic and probabilistic company fundamentals forecasting models on real company data. We observe that deep learning models provide superior forcasting performance to classical models, in particular when considering uncertainty estimation. To validate the findings, we compare them to human analyst expectations and find that their accuracy is comparable to the automatic forecasts. We further show how these high-quality forecasts can benefit automated stock allocation. We close by presenting possible ways of integrating domain experts to further improve performance and increase reliability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)