Authors

Summary

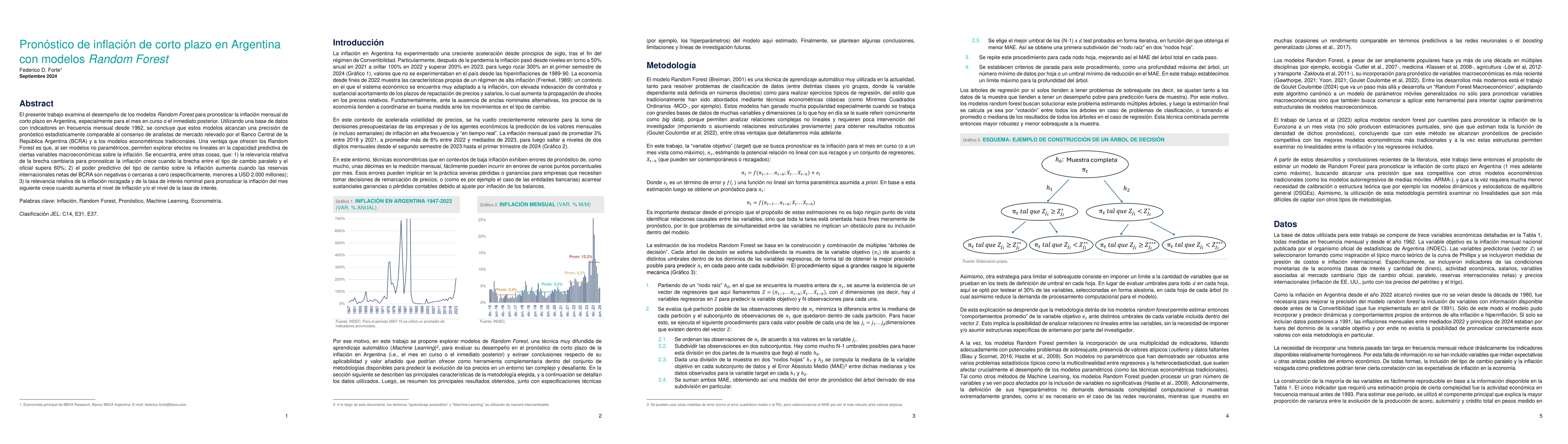

This paper examines the performance of Random Forest models in forecasting short-term monthly inflation in Argentina, based on a database of monthly indicators since 1962. It is found that these models achieve forecast accuracy that is statistically comparable to the consensus of market analysts' expectations surveyed by the Central Bank of Argentina (BCRA) and to traditional econometric models. One advantage of Random Forest models is that, as they are non-parametric, they allow for the exploration of nonlinear effects in the predictive power of certain macroeconomic variables on inflation. Among other findings, the relative importance of the exchange rate gap in forecasting inflation increases when the gap between the parallel and official exchange rates exceeds 60%. The predictive power of the exchange rate on inflation rises when the BCRA's net international reserves are negative or close to zero (specifically, below USD 2 billion). The relative importance of inflation inertia and the nominal interest rate in forecasting the following month's inflation increases when the nominal levels of inflation and/or interest rates rise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandom Forest of Epidemiological Models for Influenza Forecasting

Ajitesh Srivastava, Majd Al Aawar

Short-Term Load Forecasting Using AMI Data

Sarwan Ali, Haris Mansoor, Imdadullah Khan et al.

Inflation Determinants in Argentina (2004-2022)

Pablo de la Vega, Guido Zack, Jimena Calvo et al.

No citations found for this paper.

Comments (0)