Summary

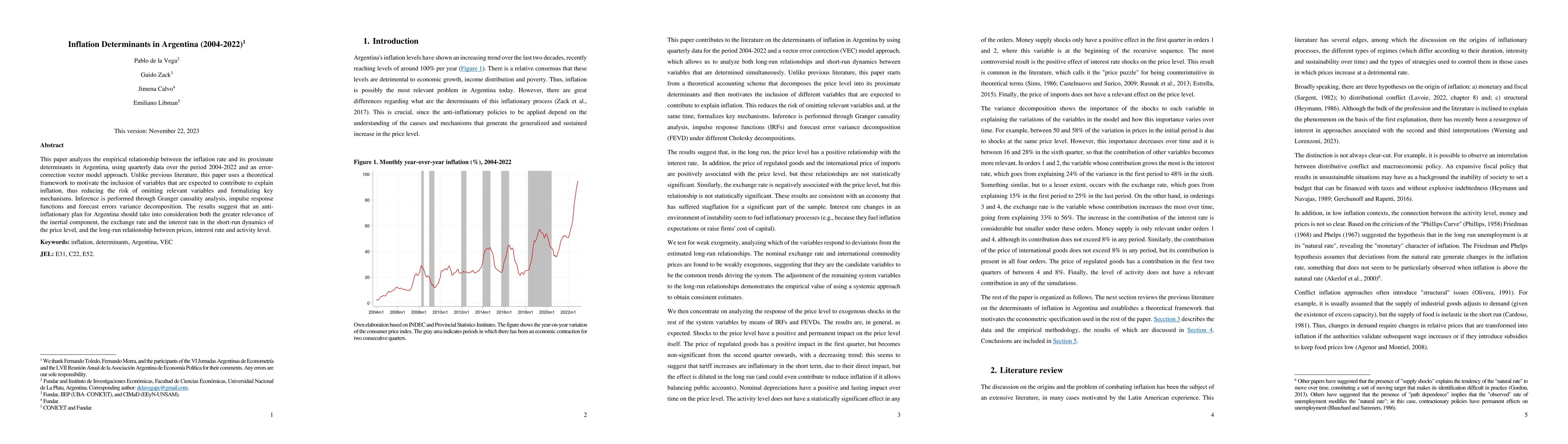

This paper analyzes the empirical relationship between the inflation rate and its proximate determinants in Argentina, using quarterly data over the period 2004-2022 and an error-correction vector model approach. Unlike previous literature, this paper uses a theoretical framework to motivate the inclusion of variables that are expected to contribute to explain inflation, thus reducing the risk of omitting relevant variables and formalizing key mechanisms. Inference is performed through Granger causality analysis, impulse response functions and forecast errors variance decomposition. The results suggest that an anti-inflationary plan for Argentina should take into consideration both the greater relevance of the inertial component, the exchange rate and the interest rate in the short-run dynamics of the price level, and the long-run relationship between prices, interest rate and activity level.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting short-term inflation in Argentina with Random Forest Models

Federico Daniel Forte

Trends and Determinants of Skilled Birth Attendants Use among Women of Reproductive Age in Tanzania: Evidence from the 2004/05-2022 National Surveys

Stephano, E. E., Mwalingo, T. P., Majengo, V. G. et al.

Trends and Determinants of Caesarean Section among Reproductive-age Women (2004/05-2022): A Multilevel Analysis of Demographic and Health Survey

Stephano, E. E., Mwalingo, T. P., Moshi, F. V. et al.

An Examination of Ranked Choice Voting in the United States, 2004-2022

David McCune, Adam Graham-Squire

No citations found for this paper.

Comments (0)