Summary

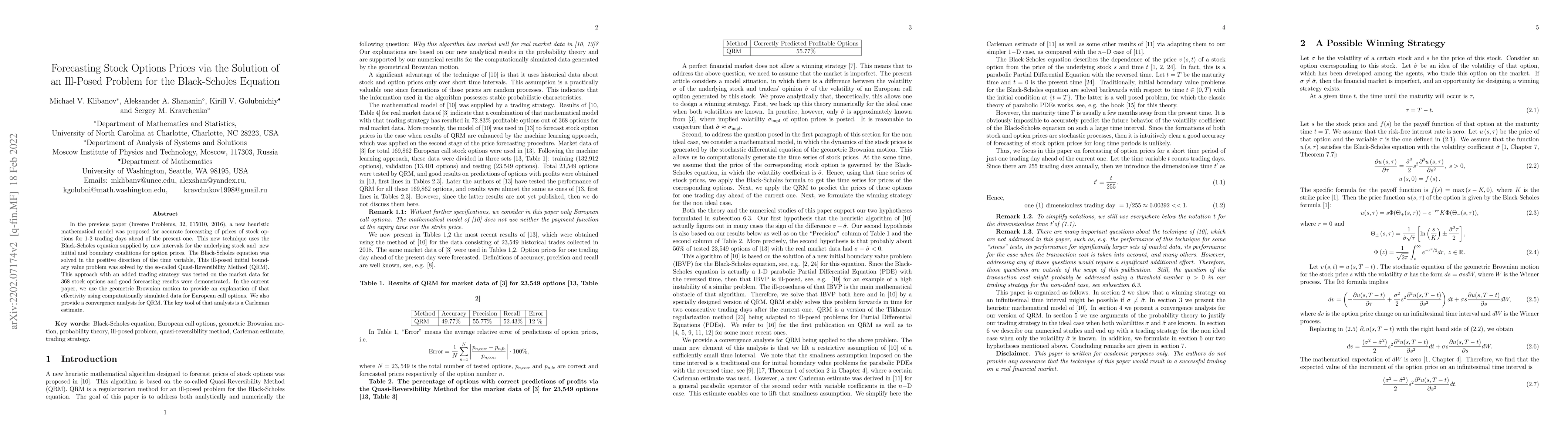

In the previous paper (Inverse Problems, 32, 015010, 2016), a new heuristic mathematical model was proposed for accurate forecasting of prices of stock options for 1-2 trading days ahead of the present one. This new technique uses the Black-Scholes equation supplied by new intervals for the underlying stock and new initial and boundary conditions for option prices. The Black-Scholes equation was solved in the positive direction of the time variable, This ill-posed initial boundary value problem was solved by the so-called Quasi-Reversibility Method (QRM). This approach with an added trading strategy was tested on the market data for 368 stock options and good forecasting results were demonstrated. In the current paper, we use the geometric Brownian motion to provide an explanation of that effectivity using computationally simulated data for European call options. We also provide a convergence analysis for QRM. The key tool of that analysis is a Carleman estimate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplication of Neural Network Machine Learning to Solution of Black-Scholes Equation

Kirill V. Golubnichiy, Mikhail V. Klibanov, Andrey V. Nikitin

Neural Network Learning of Black-Scholes Equation for Option Pricing

Daniel de Souza Santos, Tiago Alessandro Espinola Ferreira

| Title | Authors | Year | Actions |

|---|

Comments (0)