Kirill V. Golubnichiy

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

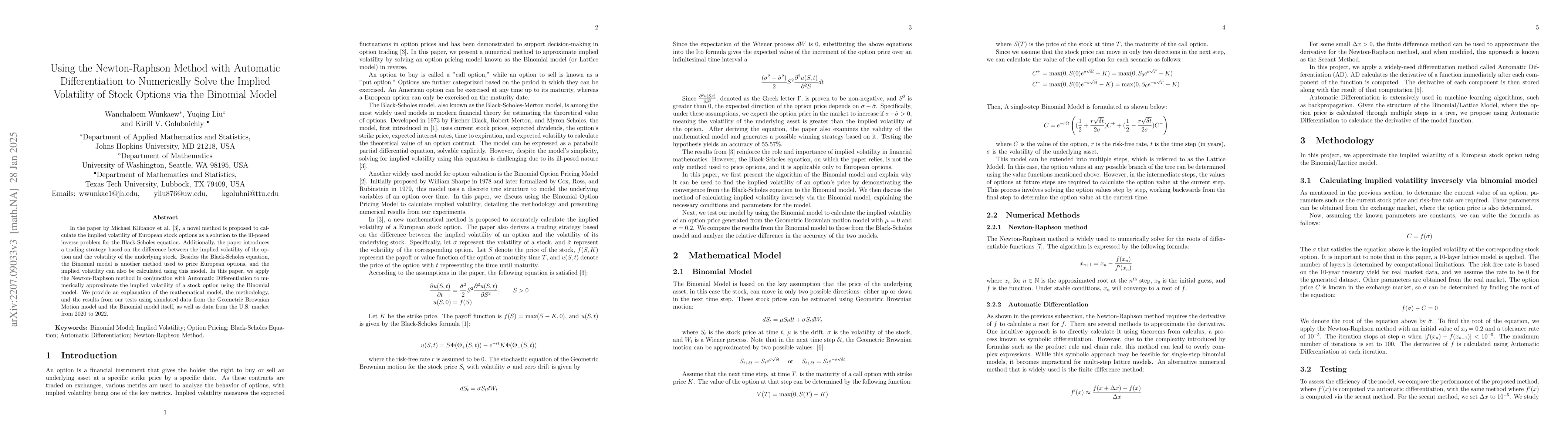

Optimizing Stock Option Forecasting with the Assembly of Machine Learning Models and Improved Trading Strategies

This paper introduced key aspects of applying Machine Learning (ML) models, improved trading strategies, and the Quasi-Reversibility Method (QRM) to optimize stock option forecasting and trading res...

Solving the Stock Option Forecast problem by a numerical method for the Black-Scholes Equation with Machine Learning Classification Model

We proposed classification models that utilize the result from the Quasi-Reversibility Method, which solves the Black-Scholes equation to forecast the option prices one day in advance. Combining the...

Application of Convolutional Neural Networks with Quasi-Reversibility Method Results for Option Forecasting

This paper presents a novel way to apply mathematical finance and machine learning (ML) to forecast stock options prices. Following results from the paper Quasi-Reversibility Method and Neural Netwo...

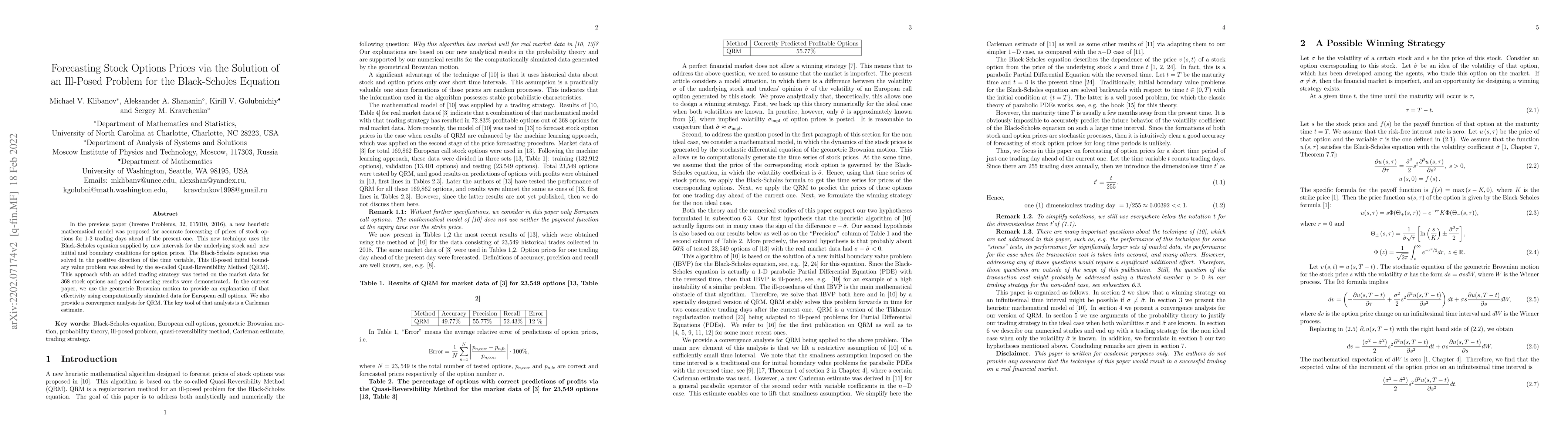

Using the Newton-Raphson Method with Automatic Differentiation to Numerically Solve Implied Volatility of Stock Option through Binomial Model

In the paper written by Klibanov et al, it proposes a novel method to calculate implied volatility of a European stock options as a solution to ill-posed inverse problem for the Black-Scholes equati...

Forecasting Stock Options Prices via the Solution of an Ill-Posed Problem for the Black-Scholes Equation

In the previous paper (Inverse Problems, 32, 015010, 2016), a new heuristic mathematical model was proposed for accurate forecasting of prices of stock options for 1-2 trading days ahead of the pres...

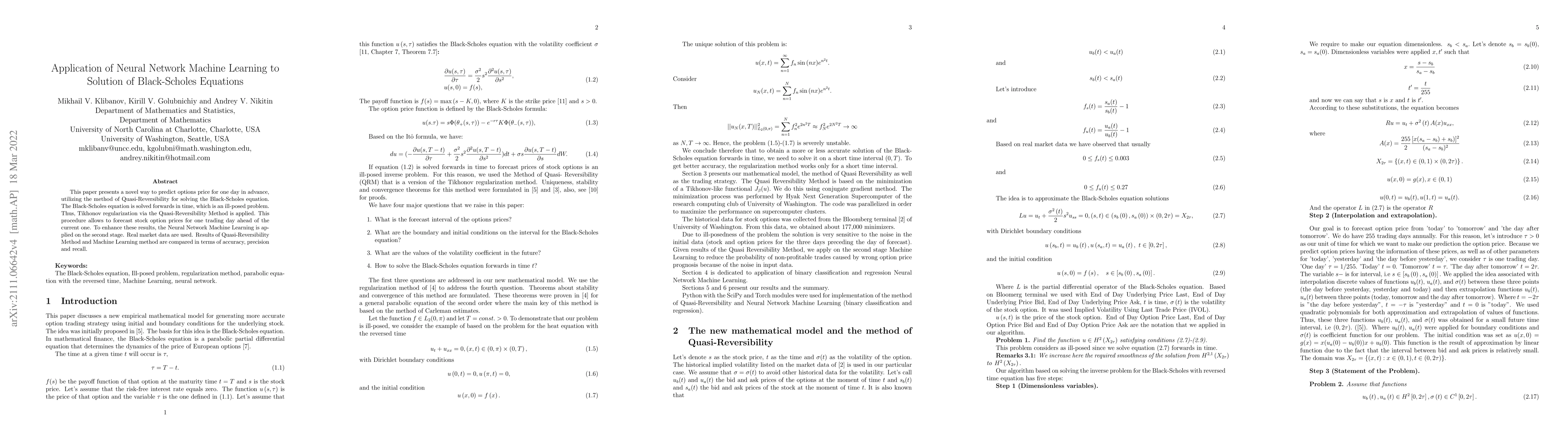

Application of Neural Network Machine Learning to Solution of Black-Scholes Equation

This paper presents a novel way to predict options price for one day in advance, utilizing the method of Quasi-Reversibility for solving the Black-Scholes equation. The Black-Scholes equation solved...

Stationary multiple euclidon solutions to the vacuum Einstein equations

The non-linear superposition of the stationary euclidon solution with an arbitrary axially symmetric stationary gravitational field on the basis of the method of variation of parameters was constructe...

Corruption via Mean Field Games

A new mathematical model governing the development of a corrupted hierarchy is derived. This model is based on the Mean Field Games theory. A retrospective problem for that model is considered. From t...