Summary

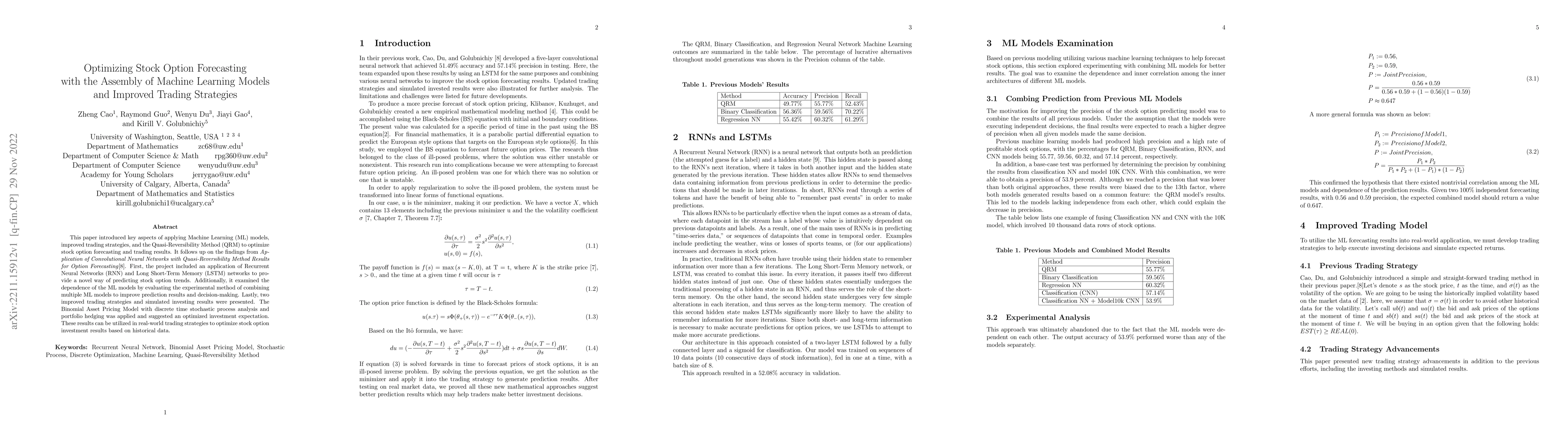

This paper introduced key aspects of applying Machine Learning (ML) models, improved trading strategies, and the Quasi-Reversibility Method (QRM) to optimize stock option forecasting and trading results. It presented the findings of the follow-up project of the research "Application of Convolutional Neural Networks with Quasi-Reversibility Method Results for Option Forecasting". First, the project included an application of Recurrent Neural Networks (RNN) and Long Short-Term Memory (LSTM) networks to provide a novel way of predicting stock option trends. Additionally, it examined the dependence of the ML models by evaluating the experimental method of combining multiple ML models to improve prediction results and decision-making. Lastly, two improved trading strategies and simulated investing results were presented. The Binomial Asset Pricing Model with discrete time stochastic process analysis and portfolio hedging was applied and suggested an optimized investment expectation. These results can be utilized in real-life trading strategies to optimize stock option investment results based on historical data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-Agent Stock Prediction Systems: Machine Learning Models, Simulations, and Real-Time Trading Strategies

Daksh Dave, Gauransh Sawhney, Vikhyat Chauhan

Directly Learning Stock Trading Strategies Through Profit Guided Loss Functions

Hao Zhang, Travis Desell, Zimeng Lyu et al.

Combining Machine Learning Classifiers for Stock Trading with Effective Feature Extraction

Md. Golam Rabiul Alam, Fahim Imtiaz, A. K. M. Amanat Ullah et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)