Summary

This paper presents a comprehensive study on stock price prediction, leveragingadvanced machine learning (ML) and deep learning (DL) techniques to improve financial forecasting accuracy. The research evaluates the performance of various recurrent neural network (RNN) architectures, including Long Short-Term Memory (LSTM) networks, Gated Recurrent Units (GRU), and attention-based models. These models are assessed for their ability to capture complex temporal dependencies inherent in stock market data. Our findings show that attention-based models outperform other architectures, achieving the highest accuracy by capturing both short and long-term dependencies. This study contributes valuable insights into AI-driven financial forecasting, offering practical guidance for developing more accurate and efficient trading systems.

AI Key Findings

Generated Jun 11, 2025

Methodology

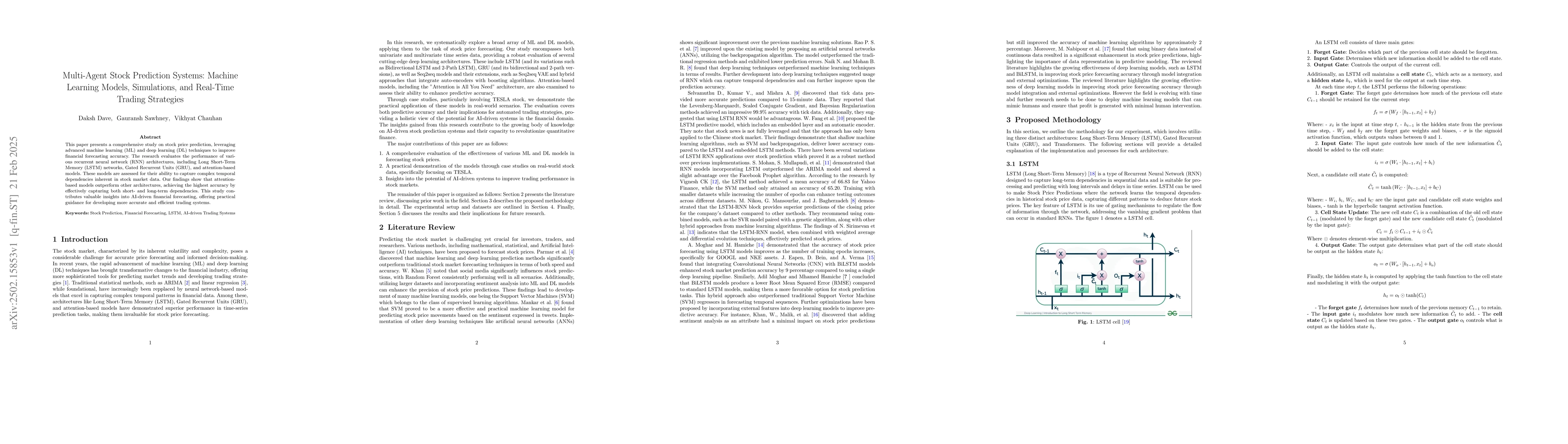

This research employs advanced machine learning and deep learning techniques, specifically evaluating recurrent neural network architectures such as LSTM, GRU, and attention-based models for stock price prediction. The study uses the Tesla stock dataset, partitioning it into training and testing subsets, and trains models using Python in a Jupyter notebook environment on Google Colab with L4 GPUs and TensorFlow.

Key Results

- Attention-based models outperform other architectures, achieving the highest accuracy by capturing both short and long-term dependencies in stock market data.

- LSTM-based models consistently outperform GRU-based models, showcasing the superiority of LSTM's richer gating mechanism in handling complex temporal dependencies.

- Bidirectional processing consistently enhances performance for both LSTM and GRU models by incorporating information from both past and future time steps.

- The attention mechanism achieves the highest overall accuracy, demonstrating its effectiveness in dynamically focusing on relevant parts of the input sequence.

- The combination of bidirectionality and Seq2Seq architectures yields notable improvements for LSTM models, though mixed results are observed for GRU models.

Significance

This research contributes valuable insights into AI-driven financial forecasting, offering practical guidance for developing more accurate and efficient trading systems by identifying the most effective machine learning models for stock price prediction.

Technical Contribution

The paper presents a comprehensive evaluation of RNN architectures, including LSTM, GRU, and attention-based models, for stock price prediction, highlighting the superior performance of attention mechanisms.

Novelty

This research distinguishes itself by focusing on the comparison of advanced RNN architectures and attention mechanisms for stock price prediction, providing a detailed analysis of their performance and offering practical guidance for financial forecasting systems.

Limitations

- The study is limited to the Tesla stock dataset, which may not generalize findings to other stocks or broader market trends.

- Model performance could be influenced by specific characteristics of the Tesla stock data, potentially limiting the applicability of results to other datasets.

Future Work

- Exploration of hybrid models integrating attention mechanisms with graph neural networks (GNNs) or transformers with domain-specific embeddings.

- Validation of model effectiveness and generalizability in real-time trading environments and diverse datasets, including multi-asset portfolios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimizing Stock Option Forecasting with the Assembly of Machine Learning Models and Improved Trading Strategies

Zheng Cao, Wenyu Du, Raymond Guo et al.

Optimizing Trading Strategies in Quantitative Markets using Multi-Agent Reinforcement Learning

Wenbo Ding, Xiao-Ping Zhang, Ercan E. Kuruoglu et al.

A Comparative Study of Machine Learning Algorithms for Stock Price Prediction Using Insider Trading Data

Nelly Elsayed, Amitabh Chakravorty

No citations found for this paper.

Comments (0)