Summary

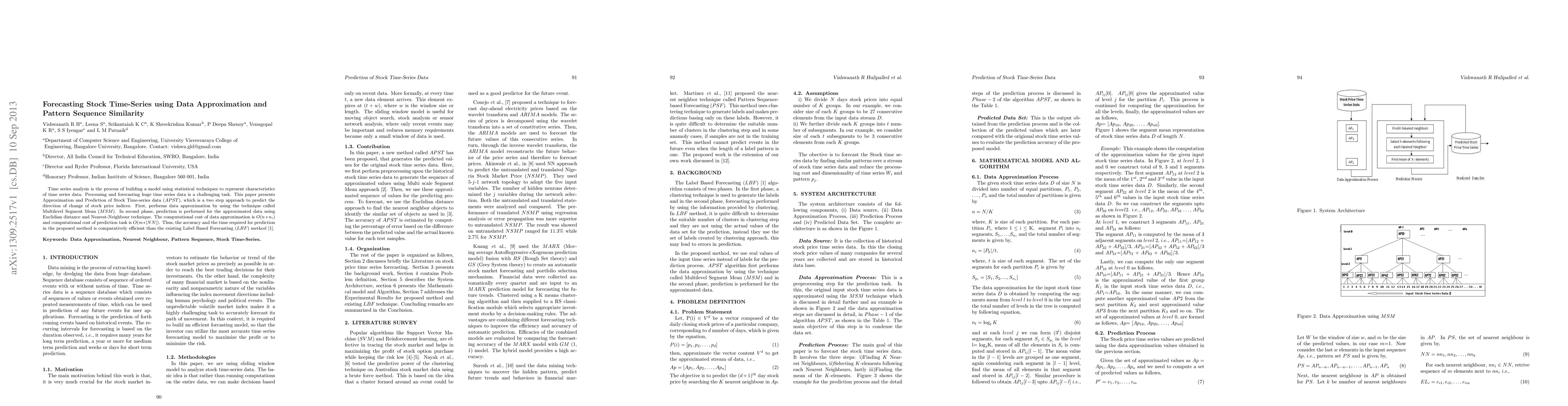

Time series analysis is the process of building a model using statistical techniques to represent characteristics of time series data. Processing and forecasting huge time series data is a challenging task. This paper presents Approximation and Prediction of Stock Time-series data (APST), which is a two step approach to predict the direction of change of stock price indices. First, performs data approximation by using the technique called Multilevel Segment Mean (MSM). In second phase, prediction is performed for the approximated data using Euclidian distance and Nearest-Neighbour technique. The computational cost of data approximation is O(n ni) and computational cost of prediction task is O(m |NN|). Thus, the accuracy and the time required for prediction in the proposed method is comparatively efficient than the existing Label Based Forecasting (LBF) method [1].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformers with Attentive Federated Aggregation for Time Series Stock Forecasting

Ye Lin Tun, Chu Myaet Thwal, Choong Seon Hong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)