Summary

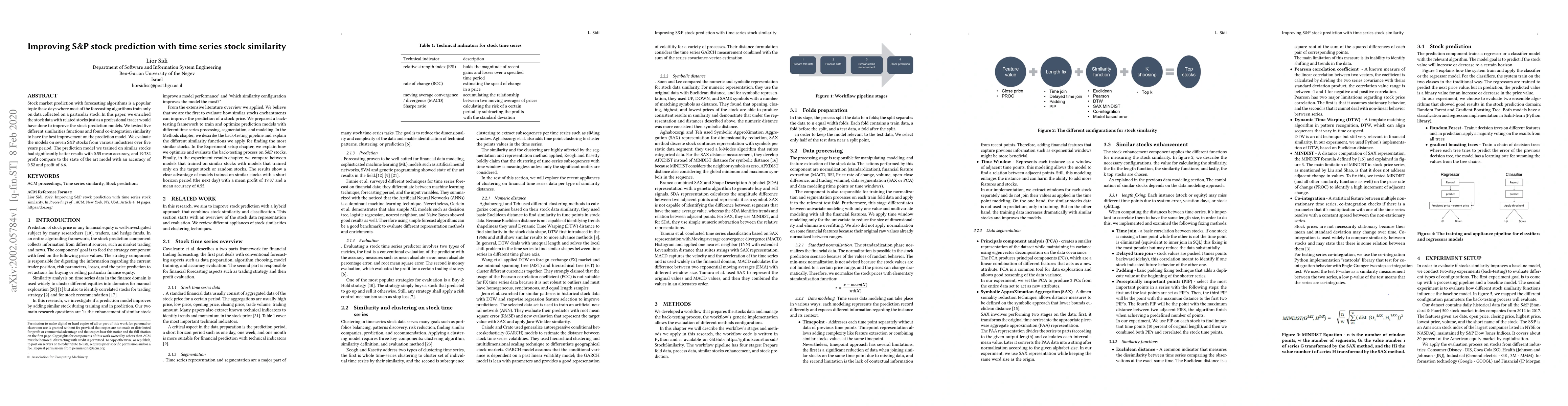

Stock market prediction with forecasting algorithms is a popular topic these days where most of the forecasting algorithms train only on data collected on a particular stock. In this paper, we enriched the stock data with related stocks just as a professional trader would have done to improve the stock prediction models. We tested five different similarities functions and found co-integration similarity to have the best improvement on the prediction model. We evaluate the models on seven S&P stocks from various industries over five years period. The prediction model we trained on similar stocks had significantly better results with 0.55 mean accuracy, and 19.782 profit compare to the state of the art model with an accuracy of 0.52 and profit of 6.6.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersS&P 500 Stock Price Prediction Using Technical, Fundamental and Text Data

Shan Zhong, David B. Hitchcock

Pre-training Time Series Models with Stock Data Customization

Mengyu Wang, Shay B. Cohen, Tiejun Ma

| Title | Authors | Year | Actions |

|---|

Comments (0)