Authors

Summary

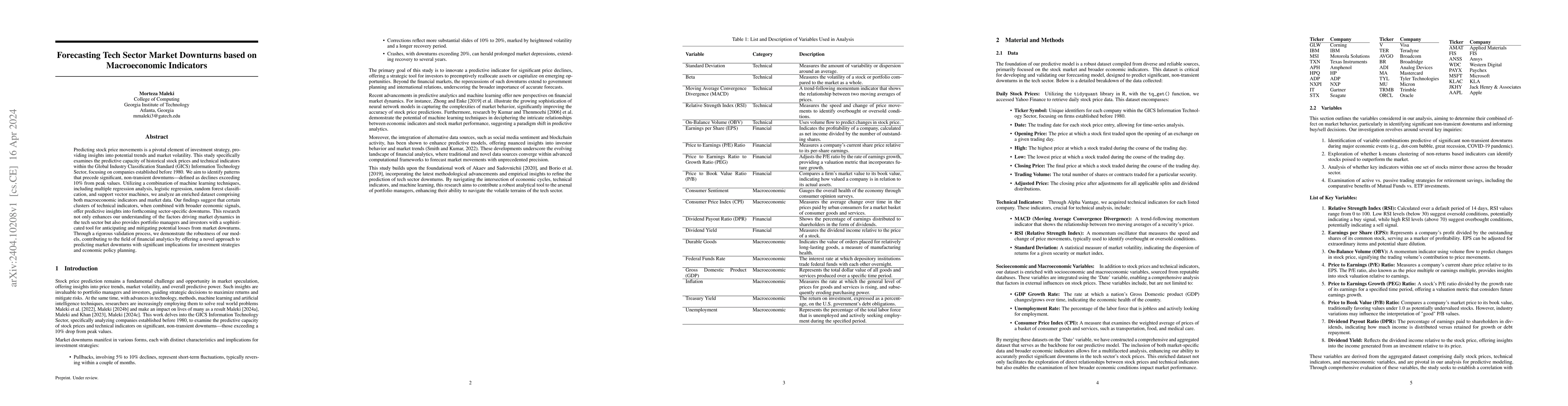

Predicting stock price movements is a pivotal element of investment strategy, providing insights into potential trends and market volatility. This study specifically examines the predictive capacity of historical stock prices and technical indicators within the Global Industry Classification Standard (GICS) Information Technology Sector, focusing on companies established before 1980. We aim to identify patterns that precede significant, non-transient downturns - defined as declines exceeding 10% from peak values. Utilizing a combination of machine learning techniques, including multiple regression analysis, logistic regression, we analyze an enriched dataset comprising both macroeconomic indicators and market data. Our findings suggest that certain clusters of technical indicators, when combined with broader economic signals, offer predictive insights into forthcoming sector-specific downturns. This research not only enhances our understanding of the factors driving market dynamics in the tech sector but also provides portfolio managers and investors with a sophisticated tool for anticipating and mitigating potential losses from market downturns. Through a rigorous validation process, we demonstrate the robustness of our models, contributing to the field of financial analytics by offering a novel approach to predicting market downturns with significant implications for investment strategies and economic policy planning.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersImpact of Major Health Events on Pharmaceutical Stocks: A Comprehensive Analysis Using Macroeconomic and Market Indicators

Morteza Maleki, SeyedAli Ghahari

No citations found for this paper.

Comments (0)