Summary

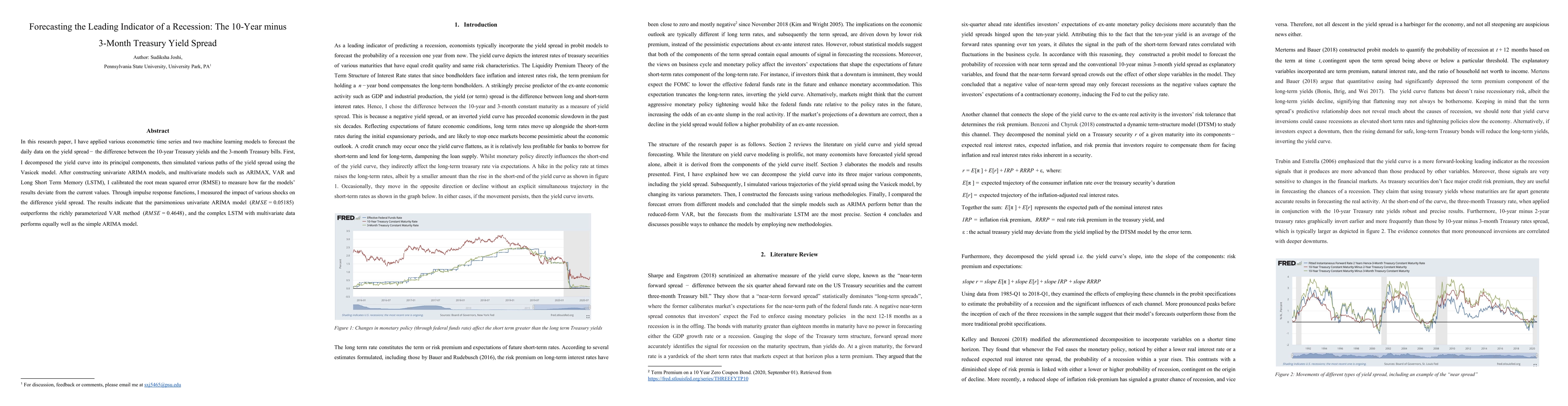

In this research paper, I have applied various econometric time series and two machine learning models to forecast the daily data on the yield spread. First, I decomposed the yield curve into its principal components, then simulated various paths of the yield spread using the Vasicek model. After constructing univariate ARIMA models, and multivariate models such as ARIMAX, VAR, and Long Short Term Memory, I calibrated the root mean squared error to measure how far the results deviate from the current values. Through impulse response functions, I measured the impact of various shocks on the difference yield spread. The results indicate that the parsimonious univariate ARIMA model outperforms the richly parameterized VAR method, and the complex LSTM with multivariate data performs equally well as the simple ARIMA model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersYield Spread Selection in Predicting Recession Probabilities: A Machine Learning Approach

Jaehyuk Choi, Desheng Ge, Kyu Ho Kang et al.

The Yield Curve as a Recession Leading Indicator. An Application for Gradient Boosting and Random Forest

Antonio A. Golpe, Pedro Cadahia Delgado, Emilio Congregado et al.

No citations found for this paper.

Comments (0)