Summary

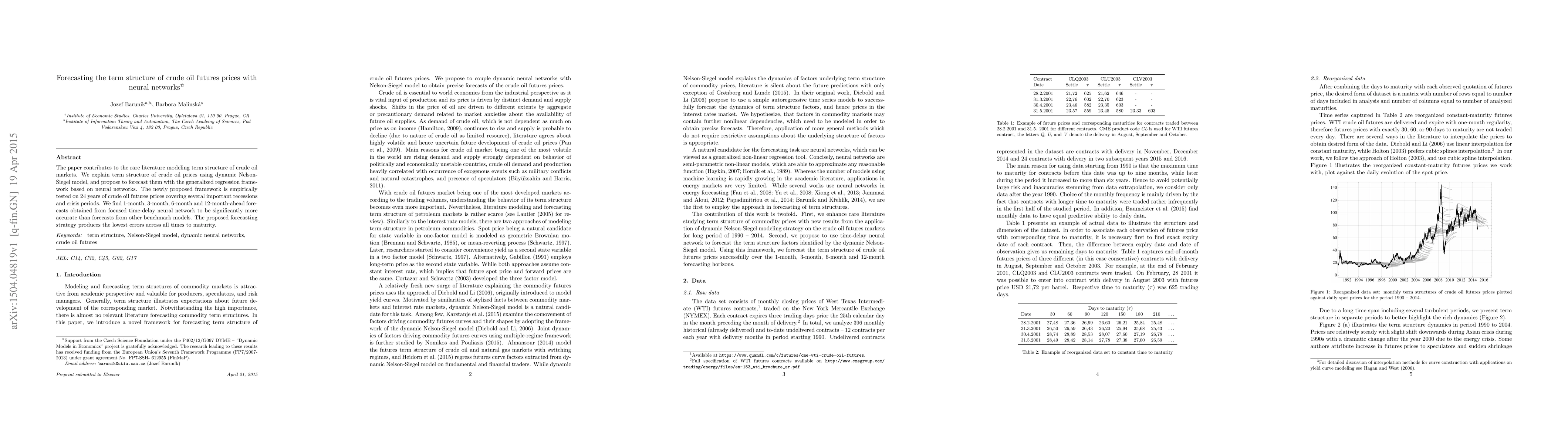

The paper contributes to the rare literature modeling term structure of crude oil markets. We explain term structure of crude oil prices using dynamic Nelson-Siegel model, and propose to forecast them with the generalized regression framework based on neural networks. The newly proposed framework is empirically tested on 24 years of crude oil futures prices covering several important recessions and crisis periods. We find 1-month, 3-month, 6-month and 12-month-ahead forecasts obtained from focused time-delay neural network to be significantly more accurate than forecasts from other benchmark models. The proposed forecasting strategy produces the lowest errors across all times to maturity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)