Authors

Summary

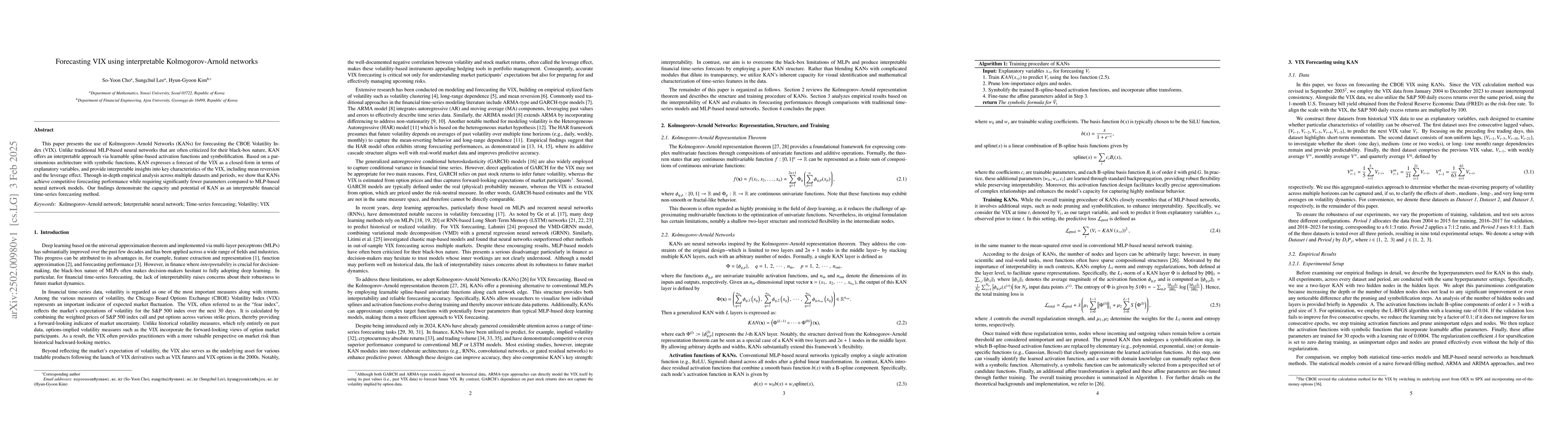

This paper presents the use of Kolmogorov-Arnold Networks (KANs) for forecasting the CBOE Volatility Index (VIX). Unlike traditional MLP-based neural networks that are often criticized for their black-box nature, KAN offers an interpretable approach via learnable spline-based activation functions and symbolification. Based on a parsimonious architecture with symbolic functions, KAN expresses a forecast of the VIX as a closed-form in terms of explanatory variables, and provide interpretable insights into key characteristics of the VIX, including mean reversion and the leverage effect. Through in-depth empirical analysis across multiple datasets and periods, we show that KANs achieve competitive forecasting performance while requiring significantly fewer parameters compared to MLP-based neural network models. Our findings demonstrate the capacity and potential of KAN as an interpretable financial time-series forecasting method.

AI Key Findings

Generated Jun 12, 2025

Methodology

This study employs Kolmogorov-Arnold Networks (KANs) to forecast the CBOE Volatility Index (VIX), contrasting with traditional MLP-based neural networks by offering an interpretable approach through learnable spline-based activation functions and symbolification.

Key Results

- KANs achieve competitive forecasting performance for VIX while requiring significantly fewer parameters compared to MLP-based neural networks.

- Symbolification improves R2 values for KAN forecasts in all cases except D2P3, indicating that a more parsimonious model can effectively work for financial time-series data with low signal-to-noise ratio.

- The closed-form symbolic expression derived from Dataset 3 captures the mean-reverting property of the VIX, highlighting KAN's ability to provide interpretable forecasts.

- Incorporating excess returns (Ret-1) robustly enhances forecasting accuracy across all datasets and periods, demonstrating that latent information in excess return data helps KAN refine VIX estimates.

- KAN consistently delivers competitive results, often achieving the best or second-best performance, across three periods, outperforming traditional statistical time-series models and neural network models like MLP and LSTM.

Significance

This research is significant as it addresses the limitations of black-box MLP-based neural networks in financial time-series forecasting by offering KANs, which are interpretable and robust, providing valuable insights into the VIX's inherent characteristics such as mean-reversion and leverage effect.

Technical Contribution

The paper introduces the use of Kolmogorov-Arnold Networks (KANs) for interpretable VIX forecasting, offering a parsimonious structure that balances accuracy with interpretability.

Novelty

The novelty of this work lies in its application of KANs to financial time-series forecasting, providing an interpretable alternative to traditional MLP-based neural networks while maintaining competitive performance.

Limitations

- The study did not explore the impact of varying KAN's depth or number of nodes extensively, focusing mainly on a two-layer structure.

- The research was conducted using specific datasets and periods, and the generalizability of findings to other financial time-series data remains to be explored.

Future Work

- Investigate the effect of varying KAN's depth and number of nodes on forecasting performance and interpretability.

- Explore the applicability of KANs on other financial time-series data beyond the VIX to assess its broader utility.

Paper Details

PDF Preview

Similar Papers

Found 4 papersZero Shot Time Series Forecasting Using Kolmogorov Arnold Networks

Abhiroop Bhattacharya, Nandinee Haq

Interpretable Reinforcement Learning for Load Balancing using Kolmogorov-Arnold Networks

Kamal Singh, Amaury Habrard, Pham Tran Anh Quang et al.

State-Space Kolmogorov Arnold Networks for Interpretable Nonlinear System Identification

Jan Decuyper, Gonçalo Granjal Cruz, Balazs Renczes et al.

No citations found for this paper.

Comments (0)