Summary

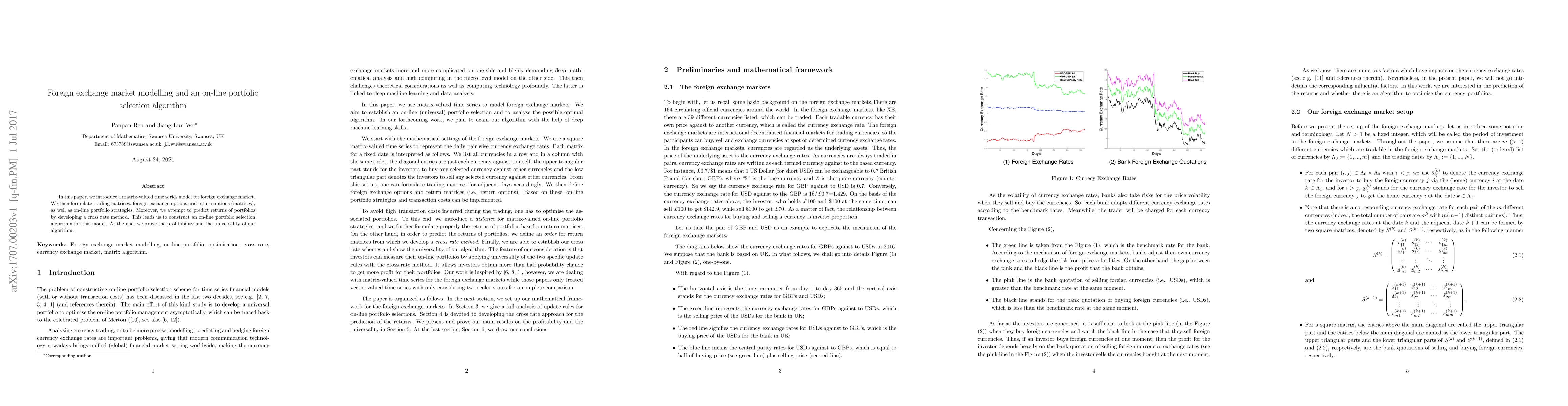

In this paper, we introduce a matrix-valued time series model for foreign exchange market. We then formulate trading matrices, foreign exchange options and return options (matrices), as well as on-line portfolio strategies. Moreover, we attempt to predict returns of portfolios by developing a cross rate method. This leads us to construct an on-line portfolio selection algorithm for this model. At the end, we prove the profitability and the universality of our algorithm.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)