Summary

The European Union and Eurozone present an inquisitive case of strongly interconnected network with high degree of dependence among nodes. This research focused on investment network of European Union and its major trading partners for specific time period 2001 to 2014. The changing investment patterns within Eurozone suggest strong financial and trade links with central and large economies. This study is about the association between portfolio investment and economic indicators with respect to financial networks. The analysis used the strongly connected investment network of Eurozone and its large trading partners. A strong correlation between, increasing or decreasing investment patterns with economic indicators of particular economy was found. Interestingly correlation patterns for network members other than Eurozone states were not as strong and depicted mild behavior. This as well, explains the significance of interconnectedness level among nodes of one network with varying centrality measures. Investment network visualization techniques helped to validate the results based on network`s statistical measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

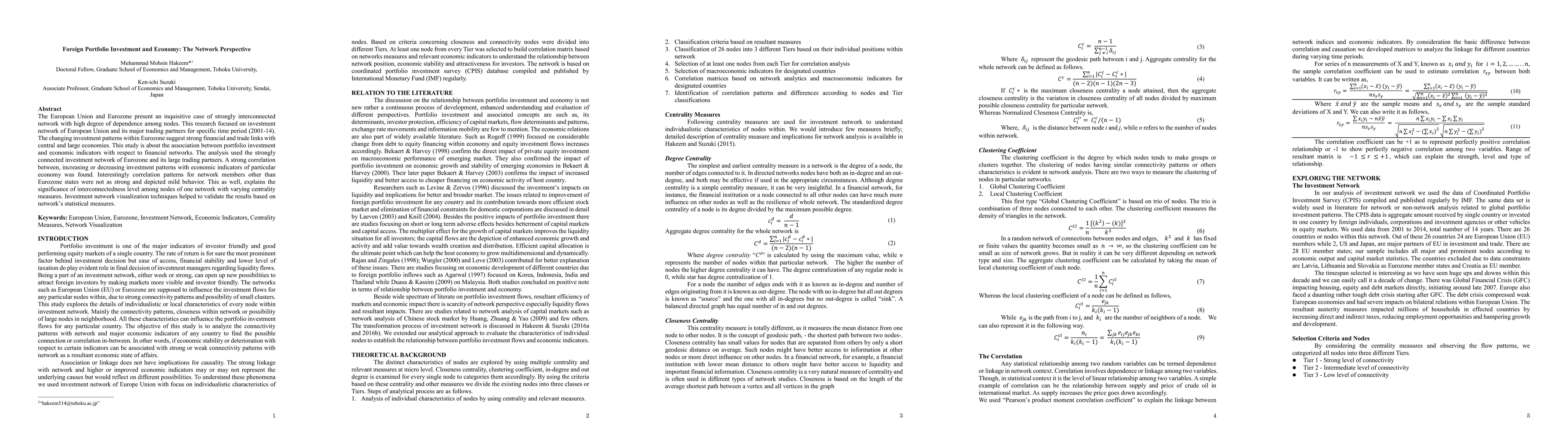

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)