Summary

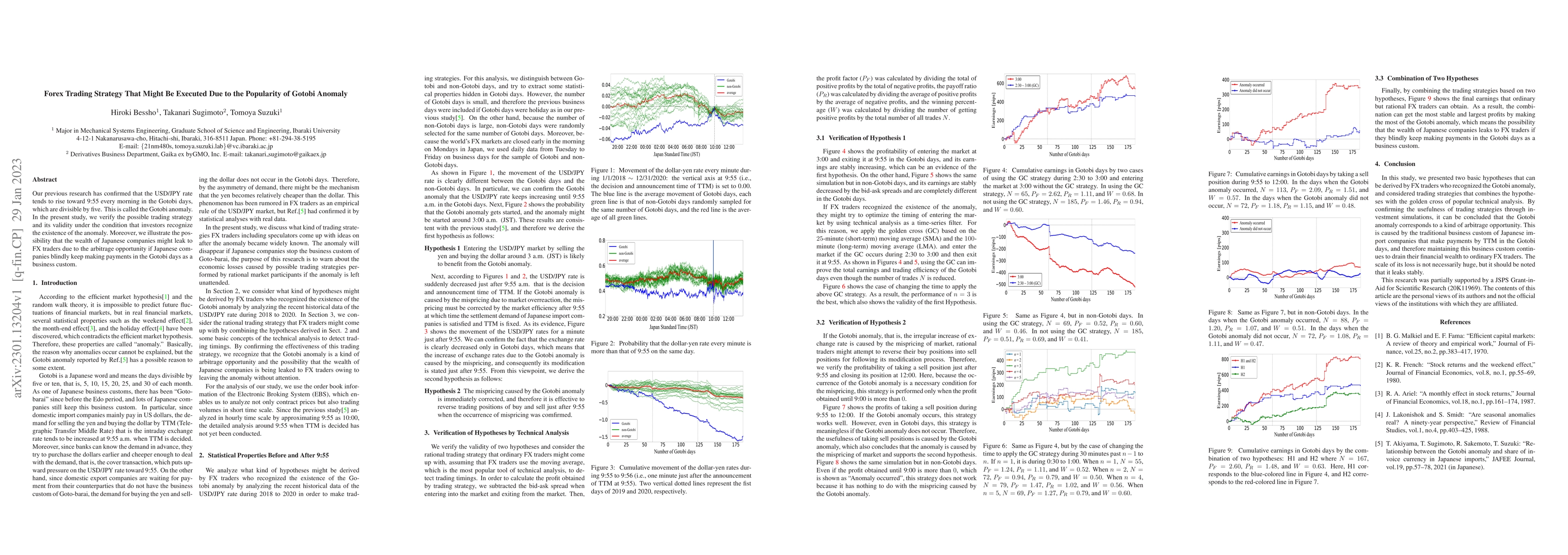

Our previous research has confirmed that the USD/JPY rate tends to rise toward 9:55 every morning in the Gotobi days, which are divisible by five. This is called the Gotobi anomaly. In the present study, we verify the possible trading strategy and its validity under the condition that investors recognize the existence of the anomaly. Moreover, we illustrate the possibility that the wealth of Japanese companies might leak to FX traders due to the arbitrage opportunity if Japanese companies blindly keep making payments in the Gotobi days as a business custom.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForex Trading Robot Using Fuzzy Logic

Alireza Nasiri, Mustafa Shabani, Hassan Nafardi

Improving Deep Reinforcement Learning Agent Trading Performance in Forex using Auxiliary Task

Davoud Sarani, Sahar Arabha, Parviz Rashidi-Khazaee

Applying News and Media Sentiment Analysis for Generating Forex Trading Signals

Oluwafemi F Olaiyapo

No citations found for this paper.

Comments (0)