Authors

Summary

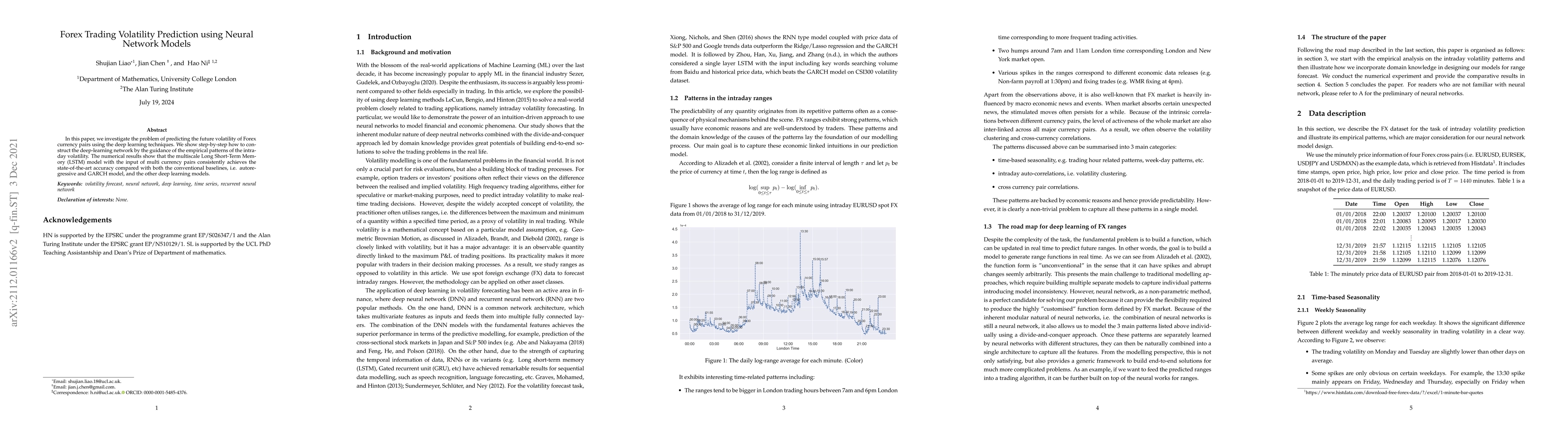

In this paper, we investigate the problem of predicting the future volatility of Forex currency pairs using the deep learning techniques. We show step-by-step how to construct the deep-learning network by the guidance of the empirical patterns of the intra-day volatility. The numerical results show that the multiscale Long Short-Term Memory (LSTM) model with the input of multi-currency pairs consistently achieves the state-of-the-art accuracy compared with both the conventional baselines, i.e. autoregressive and GARCH model, and the other deep learning models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForex Trading Robot Using Fuzzy Logic

Alireza Nasiri, Mustafa Shabani, Hassan Nafardi

Off-the-Shelf Neural Network Architectures for Forex Time Series Prediction come at a Cost

Dimitris Kalles, Theodoros Zafeiriou

| Title | Authors | Year | Actions |

|---|

Comments (0)