Summary

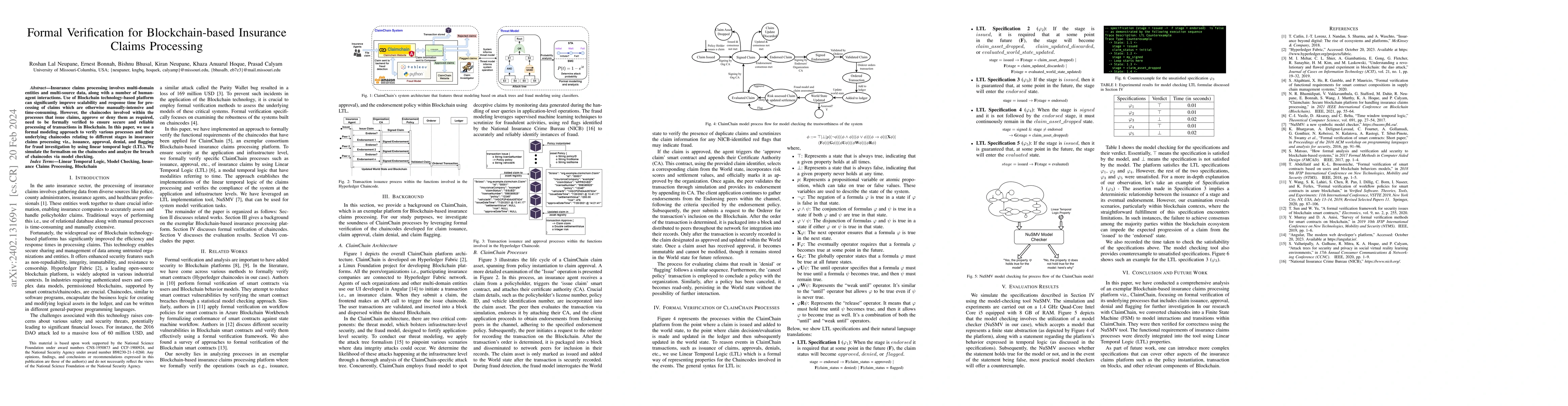

Insurance claims processing involves multi-domain entities and multi-source data, along with a number of human-agent interactions. Use of Blockchain technology-based platform can significantly improve scalability and response time for processing of claims which are otherwise manually-intensive and time-consuming. However, the chaincodes involved within the processes that issue claims, approve or deny them as required, need to be formally verified to ensure secure and reliable processing of transactions in Blockchain. In this paper, we use a formal modeling approach to verify various processes and their underlying chaincodes relating to different stages in insurance claims processing viz., issuance, approval, denial, and flagging for fraud investigation by using linear temporal logic (LTL). We simulate the formalism on the chaincodes and analyze the breach of chaincodes via model checking.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTree-Based Machine Learning Methods For Vehicle Insurance Claims Size Prediction

Edossa Merga Terefe

No citations found for this paper.

Comments (0)