Summary

Two-part models and Tweedie generalized linear models (GLMs) have been used to model loss costs for short-term insurance contract. For most portfolios of insurance claims, there is typically a large proportion of zero claims that leads to imbalances resulting in inferior prediction accuracy of these traditional approaches. This article proposes the use of tree-based models with a hybrid structure that involves a two-step algorithm as an alternative approach to these traditional models. The first step is the construction of a classification tree to build the probability model for frequency. In the second step, we employ elastic net regression models at each terminal node from the classification tree to build the distribution model for severity. This hybrid structure captures the benefits of tuning hyperparameters at each step of the algorithm; this allows for improved prediction accuracy and tuning can be performed to meet specific business objectives. We examine and compare the predictive performance of such a hybrid tree-based structure in relation to the traditional Tweedie model using both real and synthetic datasets. Our empirical results show that these hybrid tree-based models produce more accurate predictions without the loss of intuitive interpretation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

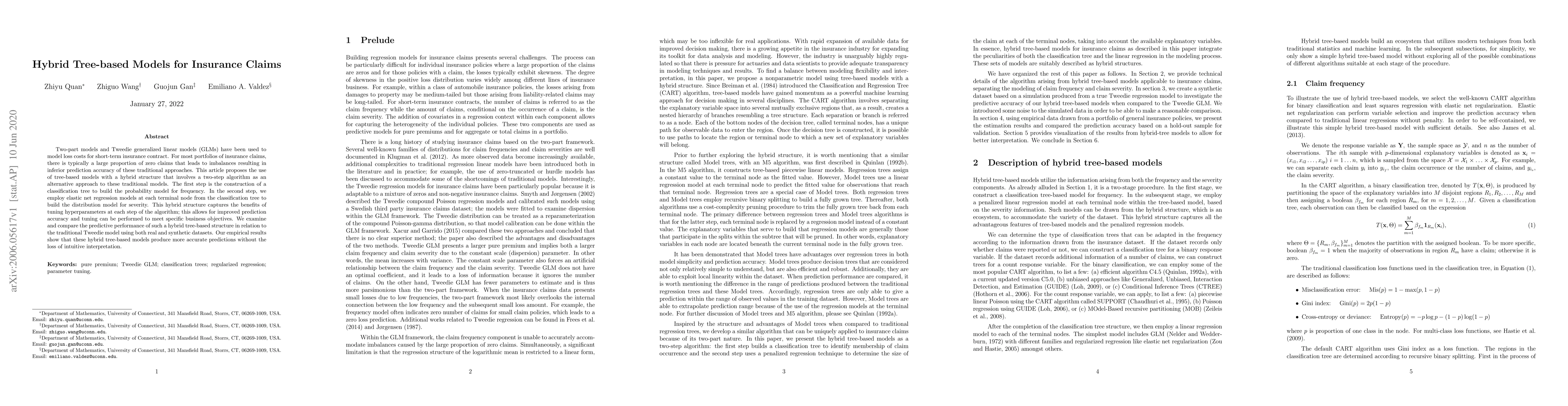

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTree-Based Machine Learning Methods For Vehicle Insurance Claims Size Prediction

Edossa Merga Terefe

Bayesian CART models for insurance claims frequency

Lanpeng Ji, Georgios Aivaliotis, Yaojun Zhang et al.

Formal Verification for Blockchain-based Insurance Claims Processing

Prasad Calyam, Bishnu Bhusal, Roshan Lal Neupane et al.

Modeling Insurance Claims using Bayesian Nonparametric Regression

Kaushik Ghosh, Mostafa Shams Esfand Abadi

No citations found for this paper.

Comments (0)