Summary

We introduce the concept of forward rank-dependent performance processes, extending the original notion to forward criteria that incorporate probability distortions. A fundamental challenge is how to reconcile the time-consistent nature of forward performance criteria with the time-inconsistency stemming from probability distortions. For this, we first propose two distinct definitions, one based on the preservation of performance value and the other on the time-consistency of policies and, in turn, establish their equivalence. We then fully characterize the viable class of probability distortion processes, providing a bifurcation-type result. Specifically, it is either the case that the probability distortions are degenerate in the sense that the investor would never invest in the risky assets, or the marginal probability distortion equals to a normalized power of the quantile function of the pricing kernel. We also characterize the optimal wealth process, whose structure motivates the introduction of a new, distorted measure and a related market. We then build a striking correspondence between the forward rank-dependent criteria in the original market and forward criteria without probability distortions in the auxiliary market. This connection also provides a direct construction method for forward rank-dependent criteria. A byproduct of our work are some new results on the so-called dynamic utilities and on time-inconsistent problems in the classical (backward) setting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

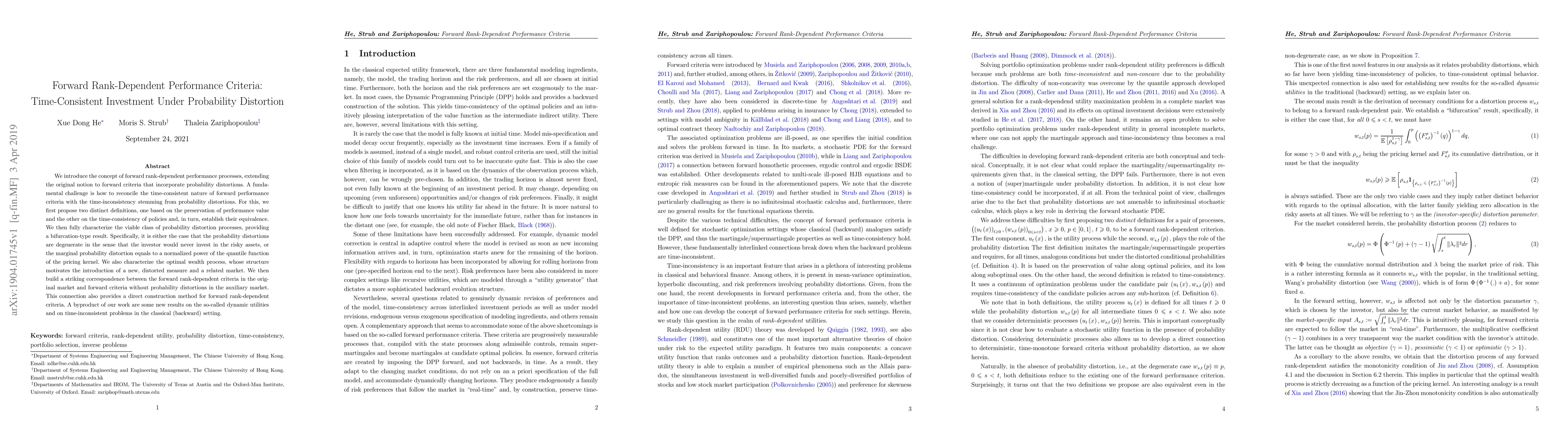

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)