Authors

Summary

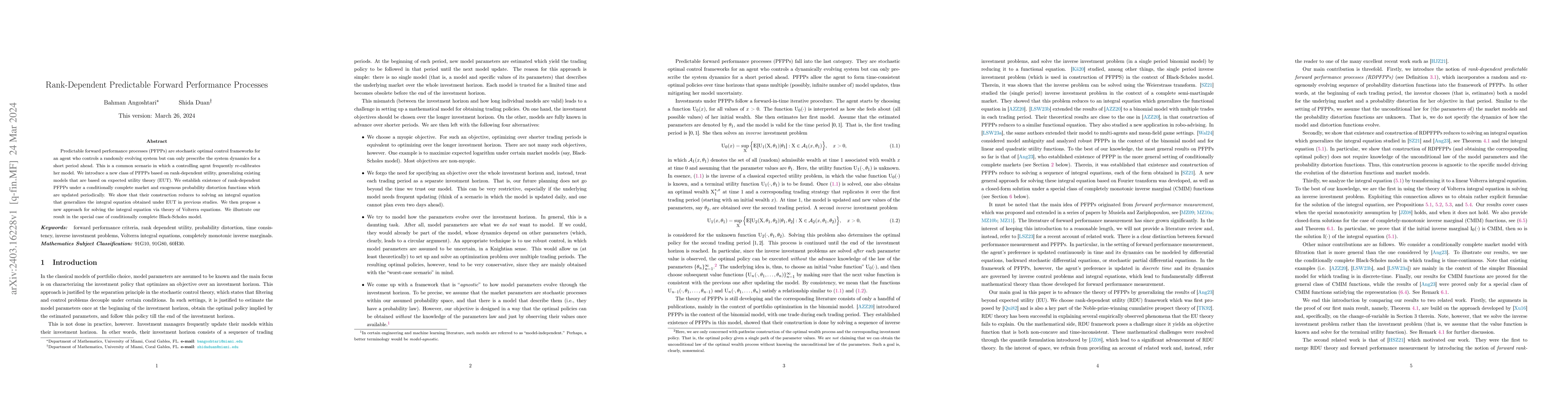

Predictable forward performance processes (PFPPs) are stochastic optimal control frameworks for an agent who controls a randomly evolving system but can only prescribe the system dynamics for a short period ahead. This is a common scenario in which a controlling agent frequently re-calibrates her model. We introduce a new class of PFPPs based on rank-dependent utility, generalizing existing models that are based on expected utility theory (EUT). We establish existence of rank-dependent PFPPs under a conditionally complete market and exogenous probability distortion functions which are updated periodically. We show that their construction reduces to solving an integral equation that generalizes the integral equation obtained under EUT in previous studies. We then propose a new approach for solving the integral equation via theory of Volterra equations. We illustrate our result in the special case of conditionally complete Black-Scholes model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredictable Forward Performance Processes in Complete Markets

Bahman Angoshtari

Predictable Forward Performance Processes: Infrequent Evaluation and Applications to Human-Machine Interactions

Yuwei Wang, Gechun Liang, Moris S. Strub

| Title | Authors | Year | Actions |

|---|

Comments (0)