Summary

Consider an ephemeral sale-and-repurchase of a security resulting in the same position before the sale and after the repurchase. A sale-and-repurchase is a wash sale if these transactions result in a loss within $\pm 30$ calendar days. Since a portfolio is essentially the same after a wash sale, any tax advantage from such a loss is not allowed. That is, after a wash sale a portfolio is unchanged so any loss captured by the wash sale is deemed to be solely for tax advantage and not investment purposes. This paper starts by exploring variations of the birthday problem to model wash sales. The birthday problem is: Determine the number of independent and identically distributed random variables required so there is a probability of at least 1/2 that two or more of these random variables share the same outcome. This paper gives necessary conditions for wash sales based on variations on the birthday problem. This allows us to answer questions such as: What is the likelihood of a wash sale in an unmanaged portfolio where purchases and sales are independent, uniform, and random? This paper ends by exploring the Littlewood-Offord problem as it relates capital gains and losses with wash sales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

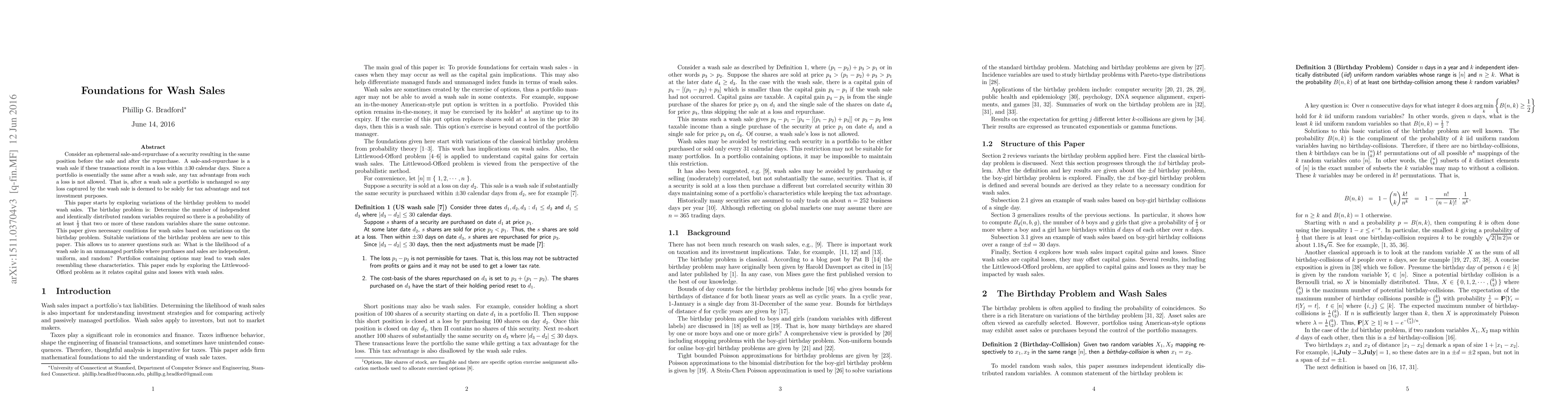

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmartSales: Sales Script Extraction and Analysis from Sales Chatlog

Tianyu Liu, Peiyi Wang, Hua Liang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)