Summary

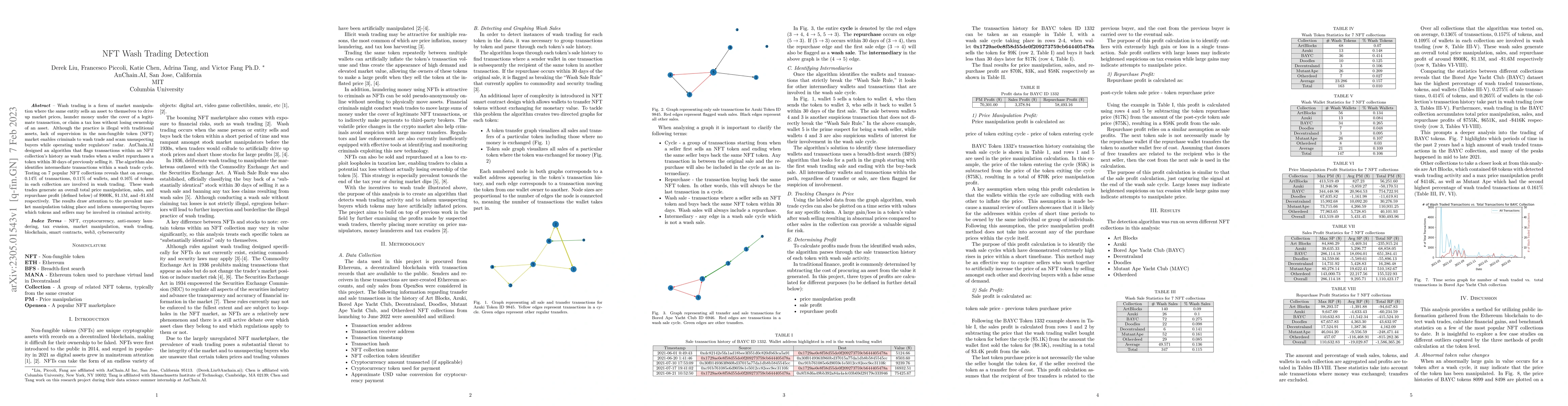

Wash trading is a form of market manipulation where the same entity sells an asset to themselves to drive up market prices, launder money under the cover of a legitimate transaction, or claim a tax loss without losing ownership of an asset. Although the practice is illegal with traditional assets, lack of supervision in the non-fungible token market enables criminals to wash trade and scam unsuspecting buyers while operating under regulators radar. AnChain.AI designed an algorithm that flags transactions within an NFT collection history as wash trades when a wallet repurchases a token within 30 days of previously selling it. The algorithm also identifies intermediate transactions within a wash trade cycle. Testing on 7 popular NFT collections reveals that on average, 0.14% of transactions, 0.11% of wallets, and 0.16% of tokens in each collection are involved in wash trading. These wash trades generate an overall total price manipulation, sales, and repurchase profit of \$900K, \$1.1M, and negative \$1.6M respectively. The results draw attention to the prevalent market manipulation taking place and inform unsuspecting buyers which tokens and sellers may be involved in criminal activity.

AI Key Findings

Generated Sep 02, 2025

Methodology

AnChain.AI designed an algorithm that flags NFT transactions as wash trades when a wallet repurchases a token within 30 days of selling it, identifying intermediate transactions in the cycle.

Key Results

- On average, 0.14% of transactions, 0.11% of wallets, and 0.16% of tokens in each of 7 tested NFT collections are involved in wash trading.

- Wash trades generate an overall total price manipulation of around $900K, sales of $1.1M, and repurchase profits of -$1.6M.

- BoredApeYachtClub (BAYC) dataset has the highest percentage of wash traded transactions (0.275% of sales, 0.414% of tokens, and 0.265% of wallets).

- ArtBlocks had 68 tokens with detected wash trading activity, with a maximum price manipulation profit of $414K.

- MutantApeYachtClub had the second-highest percentage of wash traded transactions (0.161%).

Significance

This research draws attention to prevalent market manipulation in NFTs, informing unsuspecting buyers about potentially fraudulent tokens and sellers.

Technical Contribution

Algorithm for detecting wash trades in NFT transactions, identifying wash sale cycles, and calculating financial gains from such activities.

Novelty

This research focuses on NFT market manipulation, providing a tailored solution for detecting wash trading in decentralized digital asset markets, unlike previous work on traditional financial markets.

Limitations

- Does not account for token rarity or promotional efforts that could influence value.

- Gas fees involved in each sale are not included in profit calculations.

- Pseudo-anonymous nature of blockchain technology makes it impossible to verify wallet identities.

- The assumption of collusion is based on anecdotal evidence from manual reviews, leading to potential false positives.

- Intermediary wallets flagged might be unaware participants in wash sale cycles.

Future Work

- Examine a larger sample of collections for more representative results.

- Incorporate additional features like average time between transactions, minimum time between transactions, and address-level risk indicators.

- Develop a risk engine model using the three profit calculation methods as predictive variables.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNFTDisk: Visual Detection of Wash Trading in NFT Markets

Yong Wang, Min Zhu, Feida Zhu et al.

Unveiling Wash Trading in Popular NFT Markets

Xiaoqi Li, Wenkai Li, Hongli Peng et al.

Beyond the Surface: Advanced Wash Trading Detection in Decentralized NFT Markets

Aleksandar Tošić, Niki Hrovatin, Jernej Vičič

NFT Wash Trading: Quantifying suspicious behaviour in NFT markets

Omri Ross, Victor von Wachter, Johannes Rude Jensen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)