Authors

Summary

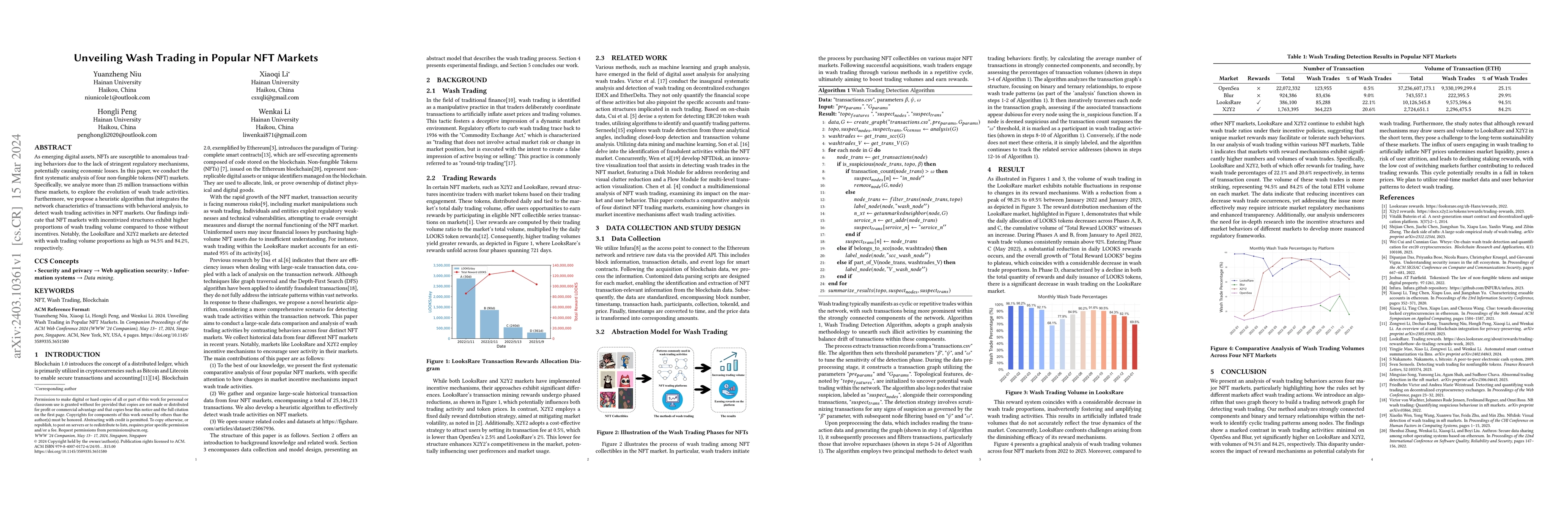

As emerging digital assets, NFTs are susceptible to anomalous trading behaviors due to the lack of stringent regulatory mechanisms, potentially causing economic losses. In this paper, we conduct the first systematic analysis of four non-fungible tokens (NFT) markets. Specifically, we analyze more than 25 million transactions within these markets, to explore the evolution of wash trade activities. Furthermore, we propose a heuristic algorithm that integrates the network characteristics of transactions with behavioral analysis, to detect wash trading activities in NFT markets. Our findings indicate that NFT markets with incentivized structures exhibit higher proportions of wash trading volume compared to those without incentives. Notably, the LooksRare and X2Y2 markets are detected with wash trading volume proportions as high as 94.5% and 84.2%, respectively.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research conducted a systematic analysis of four NFT markets, examining over 25 million transactions to explore the evolution of wash trading activities. A heuristic algorithm was proposed, integrating network characteristics with behavioral analysis to detect wash trading in NFT markets.

Key Results

- NFT markets with incentivized structures exhibit higher proportions of wash trading volume compared to those without incentives.

- LooksRare market has a wash trading volume proportion of 94.5%.

- X2Y2 market has a wash trading volume proportion of 84.2%.

Significance

This study is crucial as it highlights the vulnerability of NFT markets to wash trading, which can lead to economic losses for uninformed users and disrupt the normal functioning of the market.

Technical Contribution

The paper introduces a novel heuristic algorithm for detecting wash trading activities in NFT markets by integrating network characteristics with behavioral analysis.

Novelty

This work is novel as it is the first systematic analysis of NFT markets focusing on wash trading activities and proposes a unique algorithm tailored for detecting such illicit behaviors in NFT trading platforms.

Limitations

- The study was limited to four NFT markets, so findings may not generalize to all NFT markets.

- The heuristic algorithm, while proposed, was not extensively validated against other detection methods.

Future Work

- Further research could expand the analysis to more NFT markets to validate the findings and generalize the results.

- Development and testing of the proposed heuristic algorithm with real-world data and comparison with other detection methods.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNFTDisk: Visual Detection of Wash Trading in NFT Markets

Yong Wang, Min Zhu, Feida Zhu et al.

NFT Wash Trading: Quantifying suspicious behaviour in NFT markets

Omri Ross, Victor von Wachter, Johannes Rude Jensen et al.

Beyond the Surface: Advanced Wash Trading Detection in Decentralized NFT Markets

Aleksandar Tošić, Niki Hrovatin, Jernej Vičič

| Title | Authors | Year | Actions |

|---|

Comments (0)