Authors

Summary

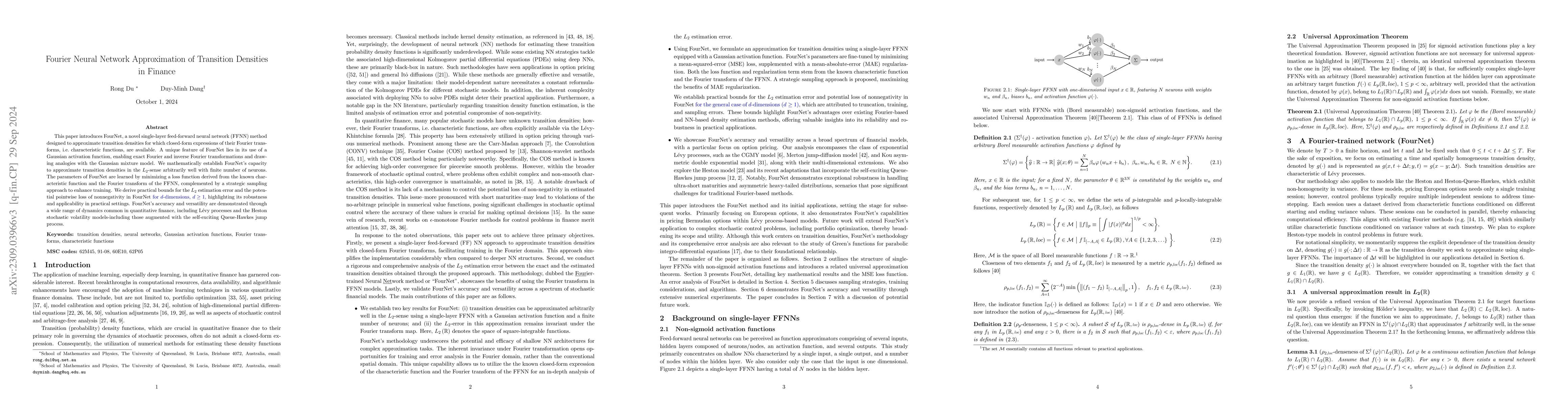

This paper introduces FourNet, a novel single-layer feed-forward neural network (FFNN) method designed to approximate transition densities for which closed-form expressions of their Fourier transforms, i.e. characteristic functions, are available. A unique feature of FourNet lies in its use of a Gaussian activation function, enabling exact Fourier and inverse Fourier transformations and drawing analogies with the Gaussian mixture model. We mathematically establish FourNet's capacity to approximate transition densities in the $L_2$-sense arbitrarily well with finite number of neurons. The parameters of FourNet are learned by minimizing a loss function derived from the known characteristic function and the Fourier transform of the FFNN, complemented by a strategic sampling approach to enhance training. We derive practical bounds for the $L_2$ estimation error and the potential pointwise loss of nonnegativity in FourNet, highlighting its robustness and applicability in practical settings. FourNet's accuracy and versatility are demonstrated through a wide range of dynamics common in quantitative finance, including L\'{e}vy processes and the Heston stochastic volatility models-including those augmented with the self-exciting Queue-Hawkes jump process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpace-Time Approximation with Shallow Neural Networks in Fourier Lebesgue spaces

Ahmed Abdeljawad, Thomas Dittrich

| Title | Authors | Year | Actions |

|---|

Comments (0)