Authors

Summary

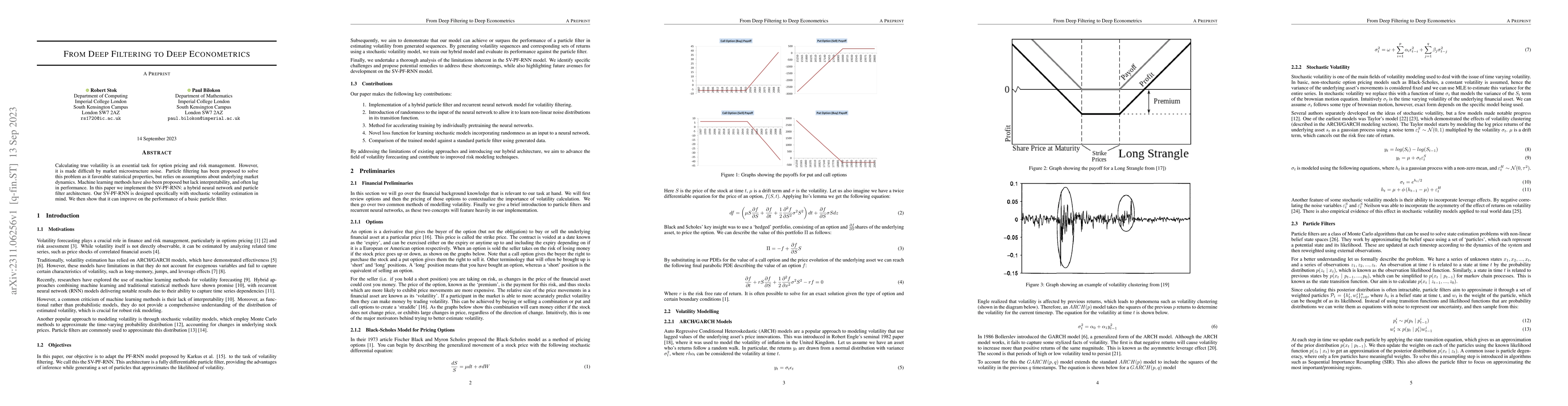

Calculating true volatility is an essential task for option pricing and risk management. However, it is made difficult by market microstructure noise. Particle filtering has been proposed to solve this problem as it favorable statistical properties, but relies on assumptions about underlying market dynamics. Machine learning methods have also been proposed but lack interpretability, and often lag in performance. In this paper we implement the SV-PF-RNN: a hybrid neural network and particle filter architecture. Our SV-PF-RNN is designed specifically with stochastic volatility estimation in mind. We then show that it can improve on the performance of a basic particle filter.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Attentional Guided Image Filtering

Xiangyang Ji, Junjun Jiang, Xianming Liu et al.

No citations found for this paper.

Comments (0)