Authors

Summary

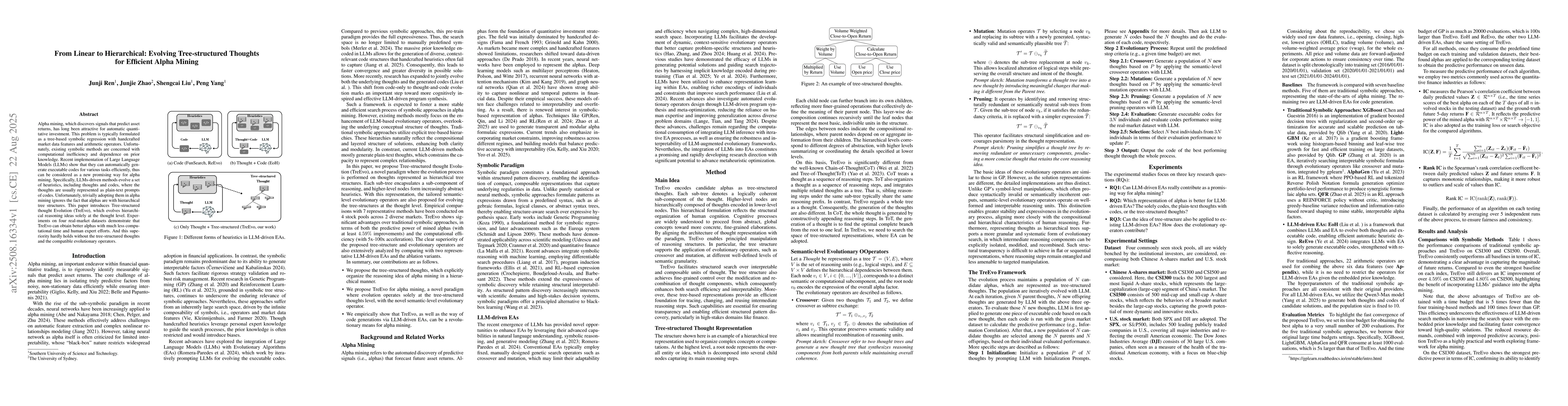

Alpha mining, which discovers signals that predict asset returns, has long been attractive for automatic quantitative investment. This problem is typically formulated as a tree-based symbolic regression with handcrafted market data features and arithmetic operators. Unfortunately, existing symbolic methods are concerned with computational inefficiency and dependence on prior knowledge. Recent implementation of Large Language Models (LLMs) show that they can automatically generate executable codes for various tasks efficiently, thus can be considered as a new promising way for alpha mining. Specifically, LLMs-driven methods evolve a set of heuristics, including thoughts and codes, where the thoughts are usually represented as plain-text prompts of codes. Unfortunately, trivially adopting them in alpha mining ignores the fact that alphas are with hierarchical tree structures. This paper introduces Tree-structured thought Evolution (TreEvo), which evolves hierarchical reasoning ideas solely at the thought level. Experiments on four real-market datasets demonstrate that TreEvo can obtain better alphas with much less computational time and human expert efforts. And this superiority hardly holds without the tree-structured thoughts and the compatible evolutionary operators.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)