Summary

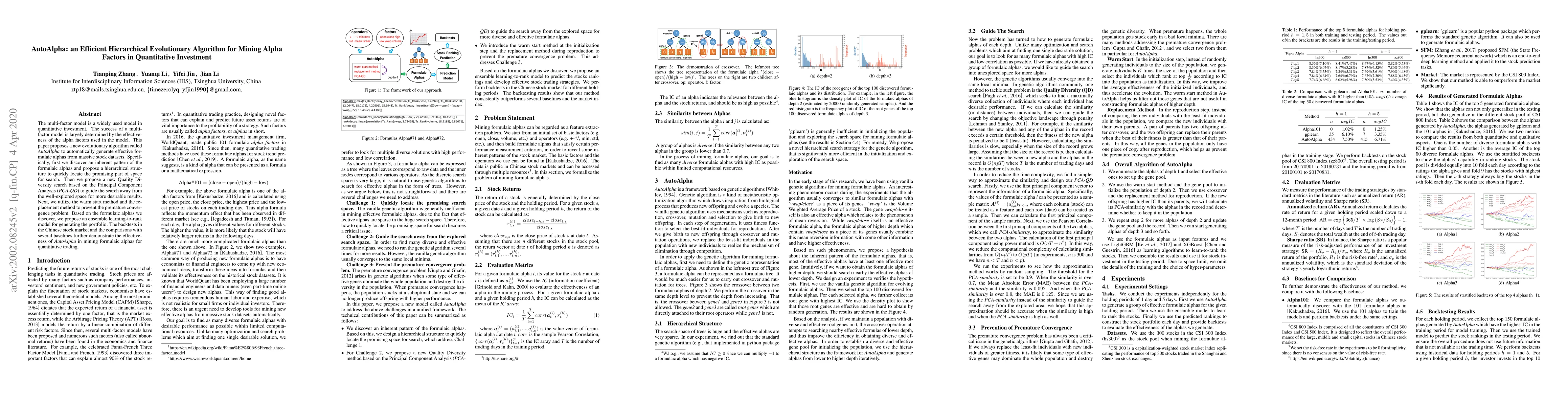

The multi-factor model is a widely used model in quantitative investment. The success of a multi-factor model is largely determined by the effectiveness of the alpha factors used in the model. This paper proposes a new evolutionary algorithm called AutoAlpha to automatically generate effective formulaic alphas from massive stock datasets. Specifically, first we discover an inherent pattern of the formulaic alphas and propose a hierarchical structure to quickly locate the promising part of space for search. Then we propose a new Quality Diversity search based on the Principal Component Analysis (PCA-QD) to guide the search away from the well-explored space for more desirable results. Next, we utilize the warm start method and the replacement method to prevent the premature convergence problem. Based on the formulaic alphas we discover, we propose an ensemble learning-to-rank model for generating the portfolio. The backtests in the Chinese stock market and the comparisons with several baselines further demonstrate the effectiveness of AutoAlpha in mining formulaic alphas for quantitative trading.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlpha-GPT: Human-AI Interactive Alpha Mining for Quantitative Investment

Jian Guo, Heung-Yeung Shum, Saizhuo Wang et al.

Alpha-GPT 2.0: Human-in-the-Loop AI for Quantitative Investment

Jian Guo, Saizhuo Wang, Hang Yuan

| Title | Authors | Year | Actions |

|---|

Comments (0)