Summary

The left tail of the implied volatility skew, coming from quotes on out-of-the-money put options, can be thought to reflect the market's assessment of the risk of a huge drop in stock prices. We analyze how this market information can be integrated into the theoretical framework of convex monetary measures of risk. In particular, we make use of indifference pricing by dynamic convex risk measures, which are given as solutions of backward stochastic differential equations (BSDEs), to establish a link between these two approaches to risk measurement. We derive a characterization of the implied volatility in terms of the solution of a nonlinear PDE and provide a small time-to-maturity expansion and numerical solutions. This procedure allows to choose convex risk measures in a conveniently parametrized class, distorted entropic dynamic risk measures, which we introduce here, such that the asymptotic volatility skew under indifference pricing can be matched with the market skew. We demonstrate this in a calibration exercise to market implied volatility data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

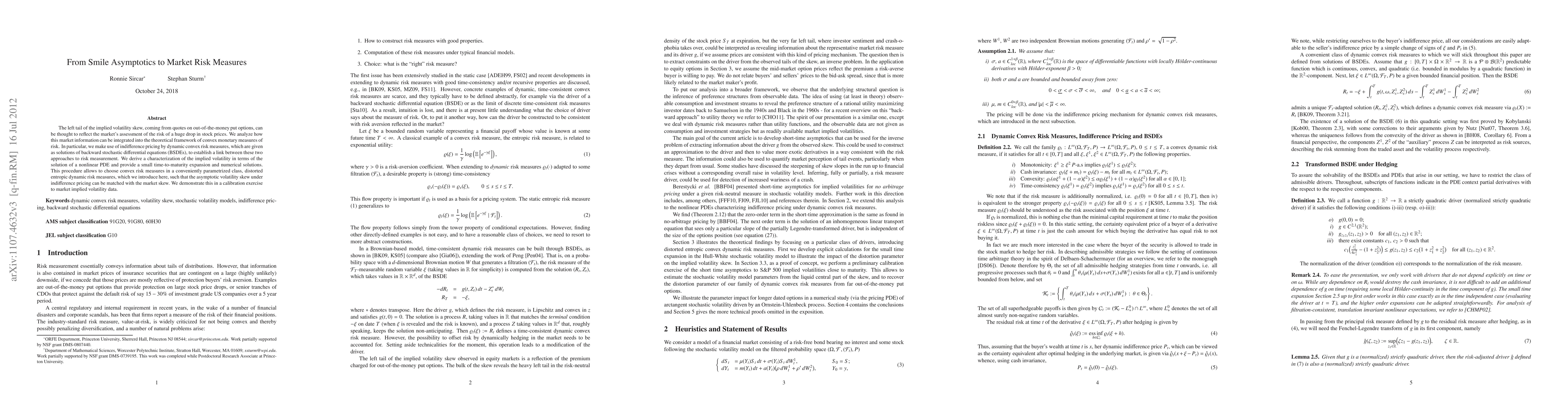

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)