Authors

Summary

We propose a new autocorrelation measure for functional time series that we term spherical autocorrelation. It is based on measuring the average angle between lagged pairs of series after having been projected onto the unit sphere. This new measure enjoys several complimentary advantages compared to existing autocorrelation measures for functional data, since it both 1) describes a notion of sign or direction of serial dependence in the series, and 2) is more robust to outliers. The asymptotic properties of estimators of the spherical autocorrelation are established, and are used to construct confidence intervals and portmanteau white noise tests. These confidence intervals and tests are shown to be effective in simulation experiments, and demonstrated in applications to model selection for daily electricity price curves, and measuring the volatility in densely observed asset price data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

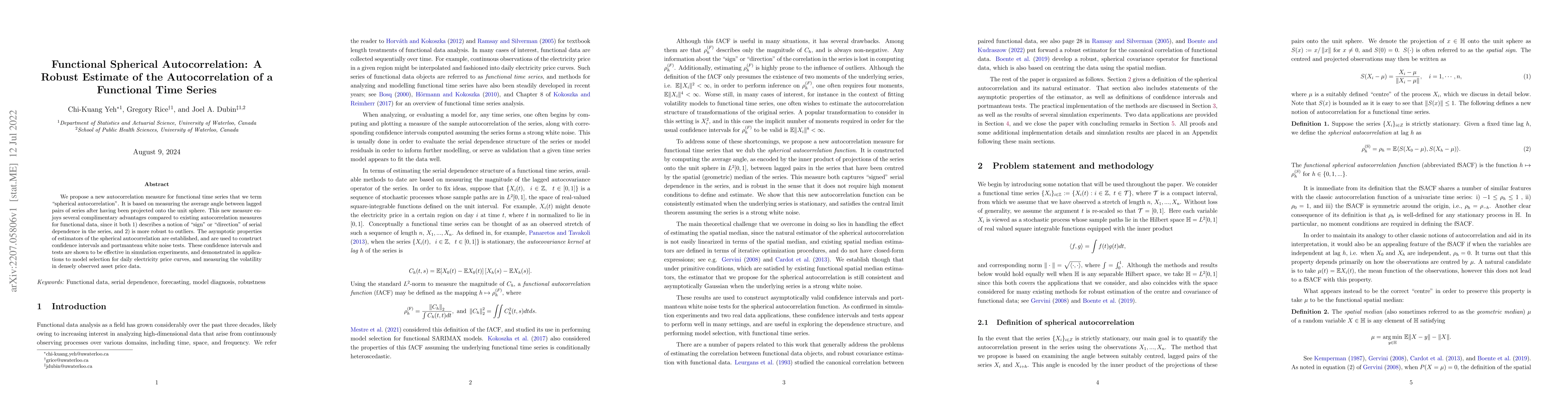

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersS-ACF: A selective estimator for the autocorrelation function of irregularly sampled time series

Edward Gillen, Didier Queloz, Joshua T. Briegal et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)