Authors

Summary

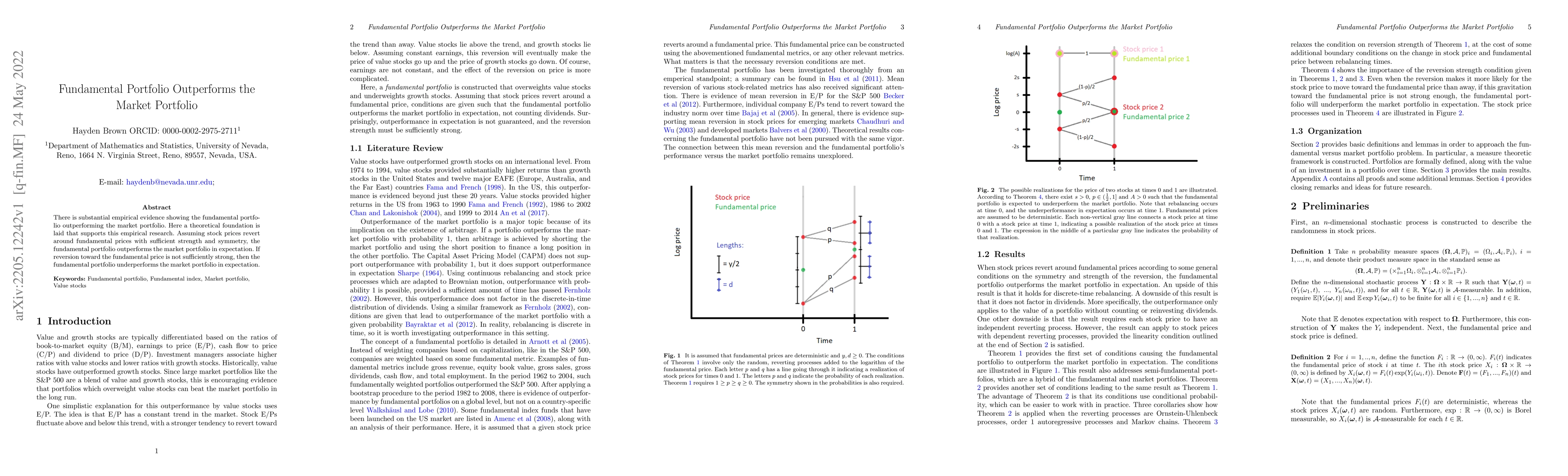

There is substantial empirical evidence showing the fundamental portfolio outperforming the market portfolio. Here a theoretical foundation is laid that supports this empirical research. Assuming stock prices revert around fundamental prices with sufficient strength and symmetry, the fundamental portfolio outperforms the market portfolio in expectation. If reversion toward the fundamental price is not sufficiently strong, then the fundamental portfolio underperforms the market portfolio in expectation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket-Adaptive Ratio for Portfolio Management

Ju-Hong Lee, Bayartsetseg Kalina, KwangTek Na

DeepClair: Utilizing Market Forecasts for Effective Portfolio Selection

Jinho Lee, Donghee Choi, Mogan Gim et al.

No citations found for this paper.

Comments (0)