Summary

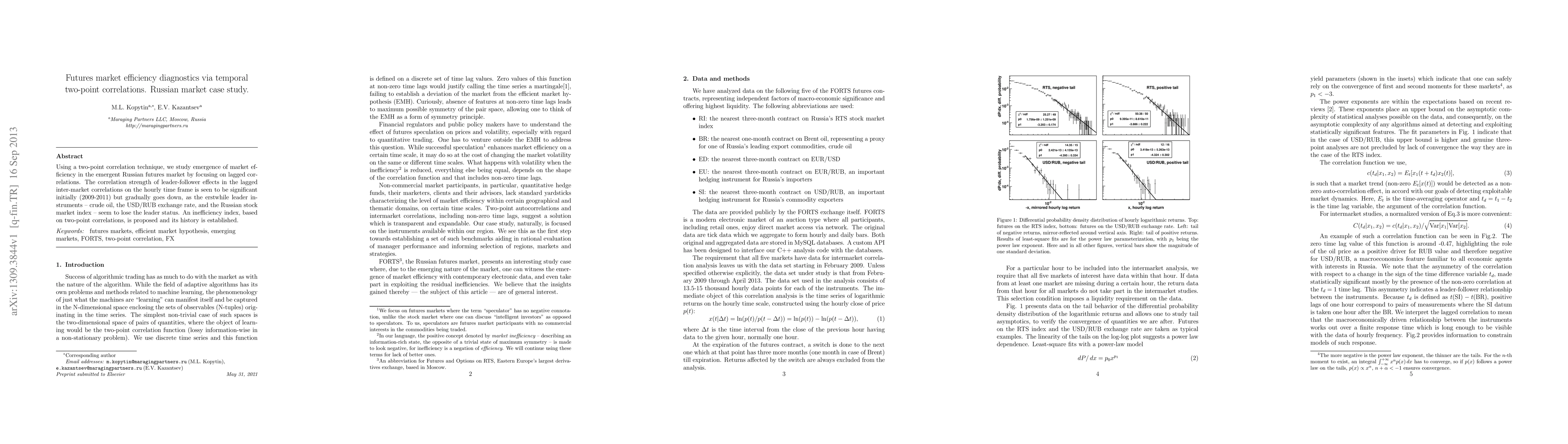

Using a two-point correlation technique, we study emergence of market efficiency in the emergent Russian futures market by focusing on lagged correlations. The correlation strength of leader-follower effects in the lagged inter-market correlations on the hourly time frame is seen to be significant initially (2009-2011) but gradually goes down, as the erstwhile leader instruments -- crude oil, the USD/RUB exchange rate, and the Russian stock market index -- seem to lose the leader status. An inefficiency index, based on two-point correlations, is proposed and its history is established.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)