Summary

We study pricing and superhedging strategies for game options in an imperfect market with default. We extend the results obtained by Kifer in \cite{Kifer} in the case of a perfect market model to the case of an imperfect market with default, when the imperfections are taken into account via the nonlinearity of the wealth dynamics. We introduce the {\em seller's price} of the game option as the infimum of the initial wealths which allow the seller to be superhedged. We {prove} that this price coincides with the value function of an associated {\em generalized} Dynkin game, recently introduced in \cite{DQS2}, expressed with a nonlinear expectation induced by a nonlinear BSDE with default jump. We moreover study the existence of superhedging strategies. We then address the case of ambiguity on the model, - for example ambiguity on the default probability - and characterize the robust seller's price of a game option as the value function of a {\em mixed generalized} Dynkin game. We study the existence of a cancellation time and a trading strategy which allow the seller to be super-hedged, whatever the model is.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

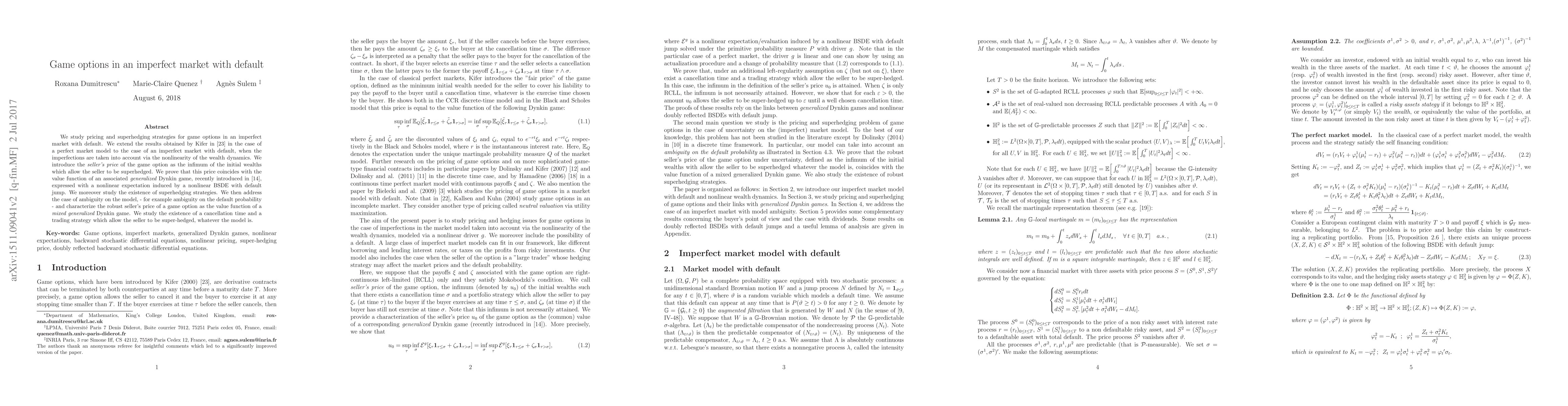

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic arbitrage with market index options

Brendan K. Beare, Juwon Seo, Zhongxi Zheng

| Title | Authors | Year | Actions |

|---|

Comments (0)