Summary

We investigate upper and lower hedging prices of multivariate contingent claims from the viewpoint of game-theoretic probability and submodularity. By considering a game between "Market" and "Investor" in discrete time, the pricing problem is reduced to a backward induction of an optimization over simplexes. For European options with payoff functions satisfying a combinatorial property called submodularity or supermodularity, this optimization is solved in closed form by using the Lov\'asz extension and the upper and lower hedging prices can be calculated efficiently. This class includes the options on the maximum or the minimum of several assets. We also study the asymptotic behavior as the number of game rounds goes to infinity. The upper and lower hedging prices of European options converge to the solutions of the Black-Scholes-Barenblatt equations. For European options with submodular or supermodular payoff functions, the Black-Scholes-Barenblatt equation is reduced to the linear Black-Scholes equation and it is solved in closed form. Numerical results show the validity of the theoretical results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

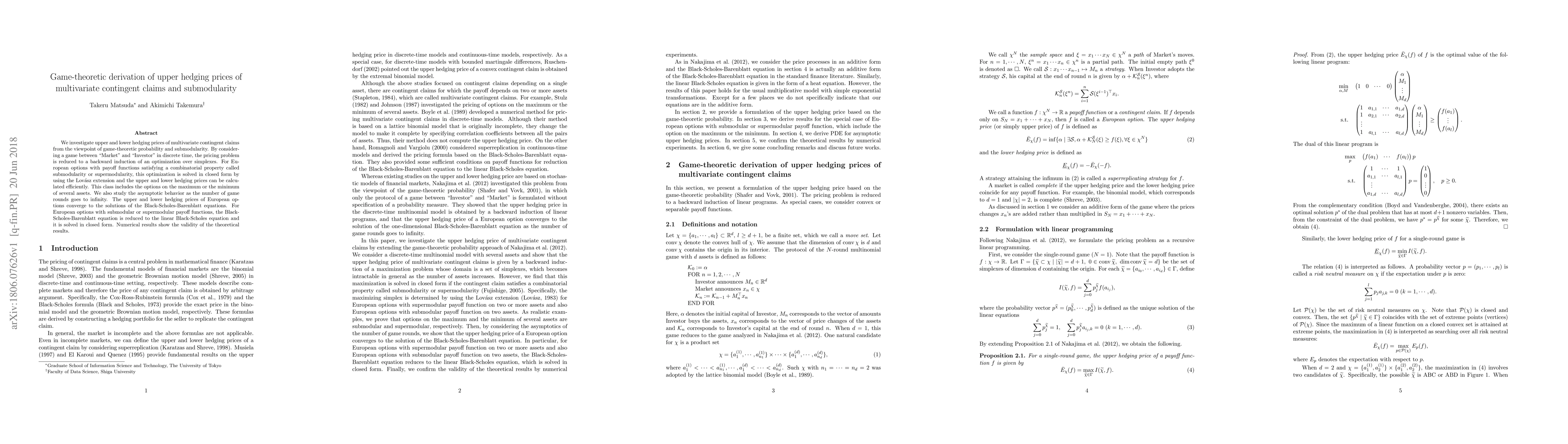

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)