Summary

Game contingent claims (GCCs) generalize American contingent claims by allowing the writer to recall the option as long as it is not exercised, at the price of paying some penalty. In incomplete markets, an appealing approach is to analyze GCCs like their European and American counterparts by solving option holder's and writer's optimal investment problems in the underlying securities. By this, partial hedging opportunities are taken into account. We extend results in the literature by solving the stochastic game corresponding to GCCs with both continuous time stopping and trading. Namely, we construct Nash equilibria by rewriting the game as a non-zero-sum stopping game in which players compare payoffs in terms of their exponential utility indifference values. As a by-product, we also obtain an existence result for the optimal exercise time of an American claim under utility indifference valuation by relating it to the corresponding nonlinear Snell envelope.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

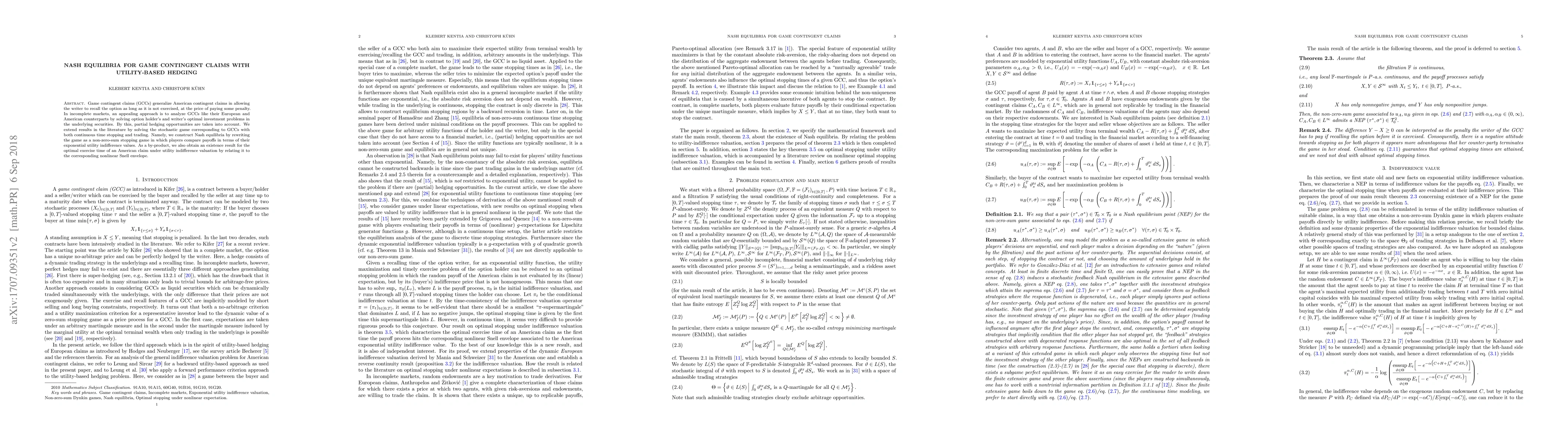

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)