Summary

This paper provides a probabilistic and statistical comparison of the log-GARCH and EGARCH models, which both rely on multiplicative volatility dynamics without positivity constraints. We compare the main probabilistic properties (strict stationarity, existence of moments, tails) of the EGARCH model, which are already known, with those of an asymmetric version of the log-GARCH. The quasi-maximum likelihood estimation of the log-GARCH parameters is shown to be strongly consistent and asymptotically normal. Similar estimation results are only available for particular EGARCH models, and under much stronger assumptions. The comparison is pursued via simulation experiments and estimation on real data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

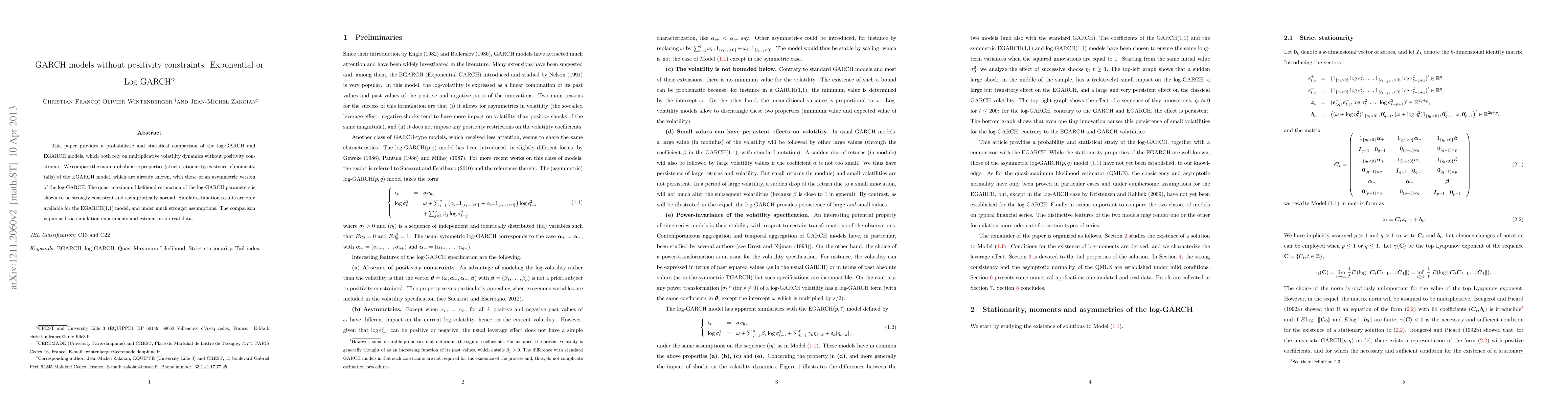

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGARCH copulas and GARCH-mimicking copulas

Alexandra Dias, Jialing Han, Alexander J. McNeil

| Title | Authors | Year | Actions |

|---|

Comments (0)