Authors

Summary

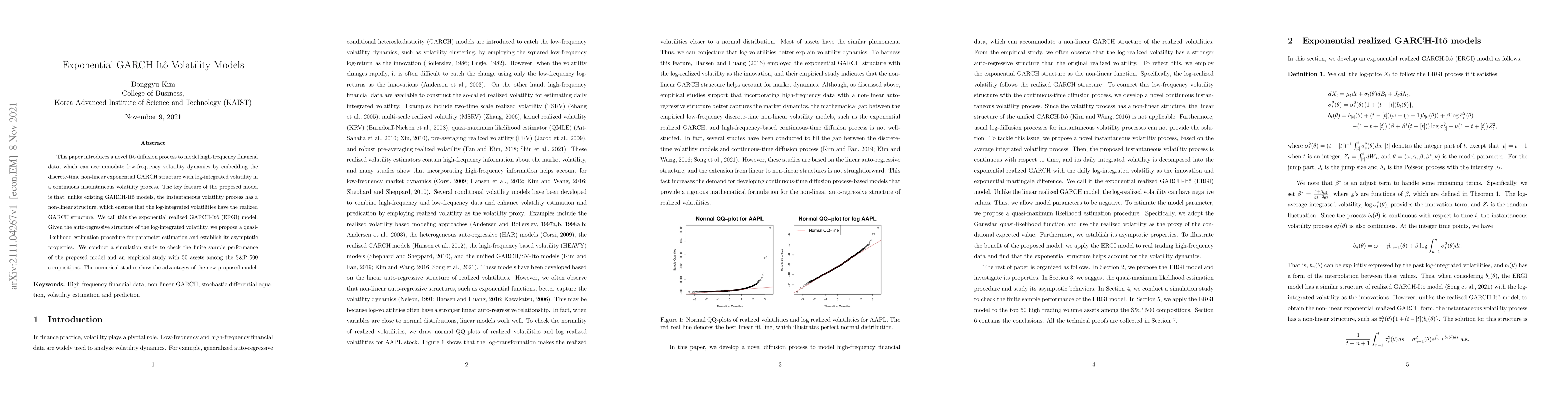

This paper introduces a novel Ito diffusion process to model high-frequency financial data, which can accommodate low-frequency volatility dynamics by embedding the discrete-time non-linear exponential GARCH structure with log-integrated volatility in a continuous instantaneous volatility process. The key feature of the proposed model is that, unlike existing GARCH-Ito models, the instantaneous volatility process has a non-linear structure, which ensures that the log-integrated volatilities have the realized GARCH structure. We call this the exponential realized GARCH-Ito (ERGI) model. Given the auto-regressive structure of the log-integrated volatility, we propose a quasi-likelihood estimation procedure for parameter estimation and establish its asymptotic properties. We conduct a simulation study to check the finite sample performance of the proposed model and an empirical study with 50 assets among the S\&P 500 compositions. The numerical studies show the advantages of the new proposed model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)