Summary

The Value-at-Risk (VaR) is a widely used instrument in financial risk management. The question of estimating the VaR of loss return distributions at extreme levels is an important question in financial applications, both from operational and regulatory perspectives; in particular, the dynamic estimation of extreme VaR given the recent past has received substantial attention. We propose here a two-step bias-reduced estimation methodology called GARCH-UGH (Unbiased Gomes-de Haan), whereby financial returns are first filtered using an AR-GARCH model, and then a bias-reduced estimator of extreme quantiles is applied to the standardized residuals to estimate one-step ahead dynamic extreme VaR. Our results indicate that the GARCH-UGH estimates are more accurate than those obtained by combining conventional AR-GARCH filtering and extreme value estimates from the perspective of in-sample and out-of-sample backtestings of historical daily returns on several financial time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

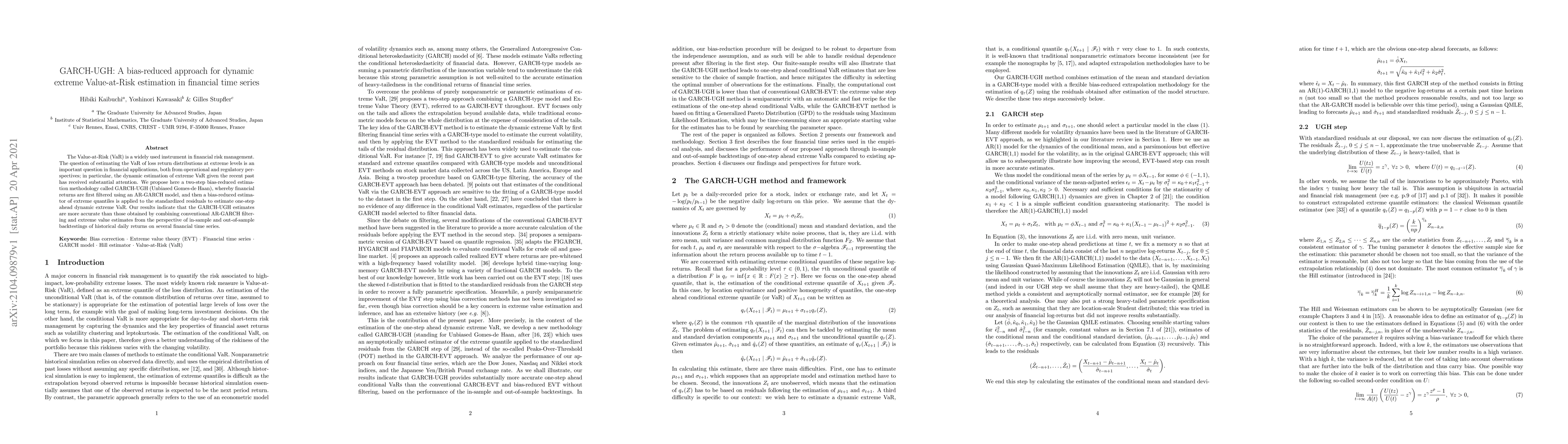

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating value at risk: LSTM vs. GARCH

Marcin Pitera, Weronika Ormaniec, Thorsten Schmidt et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)