Summary

Models for financial risk often assume that underlying asset returns are stationary. However, there is strong evidence that multivariate financial time series entail changes not only in their within-series dependence structure, but also in the cross-sectional dependence among them. In particular, the stressed Value-at-Risk of a portfolio, a popularly adopted measure of market risk, cannot be gauged adequately unless such structural breaks are taken into account in its estimation. We propose a method for consistent detection of multiple change points in high-dimensional GARCH panel data set where both individual GARCH processes and their correlations are allowed to change over time. We prove its consistency in multiple change point estimation, and demonstrate its good performance through simulation studies and an application to the Value-at-Risk problem on a real dataset. Our methodology is implemented in the R package segMGarch, available from CRAN.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

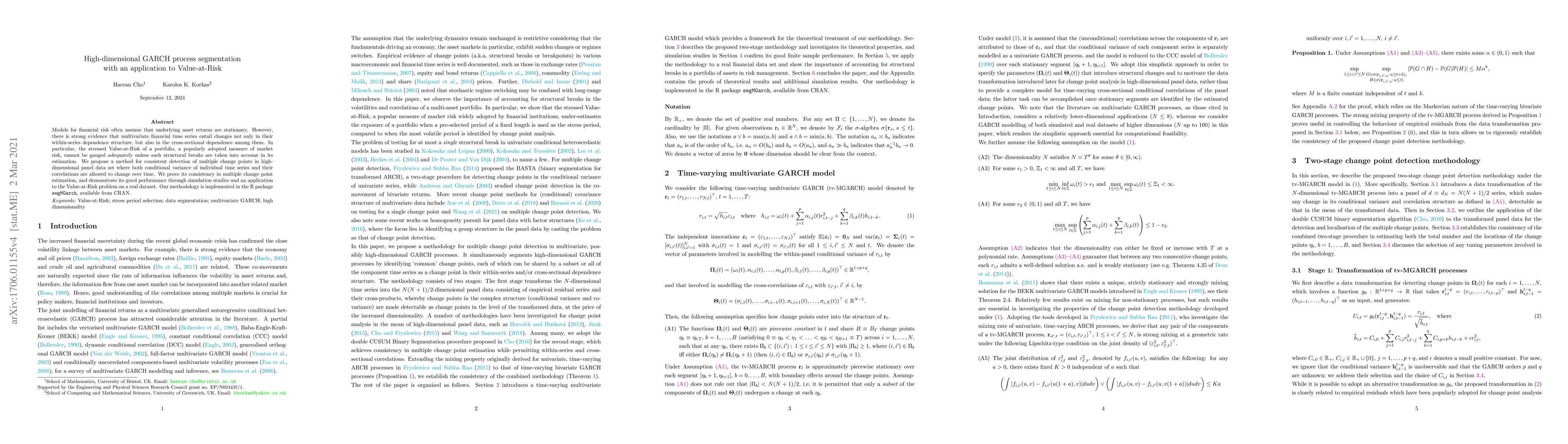

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating value at risk: LSTM vs. GARCH

Marcin Pitera, Weronika Ormaniec, Thorsten Schmidt et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)