Authors

Summary

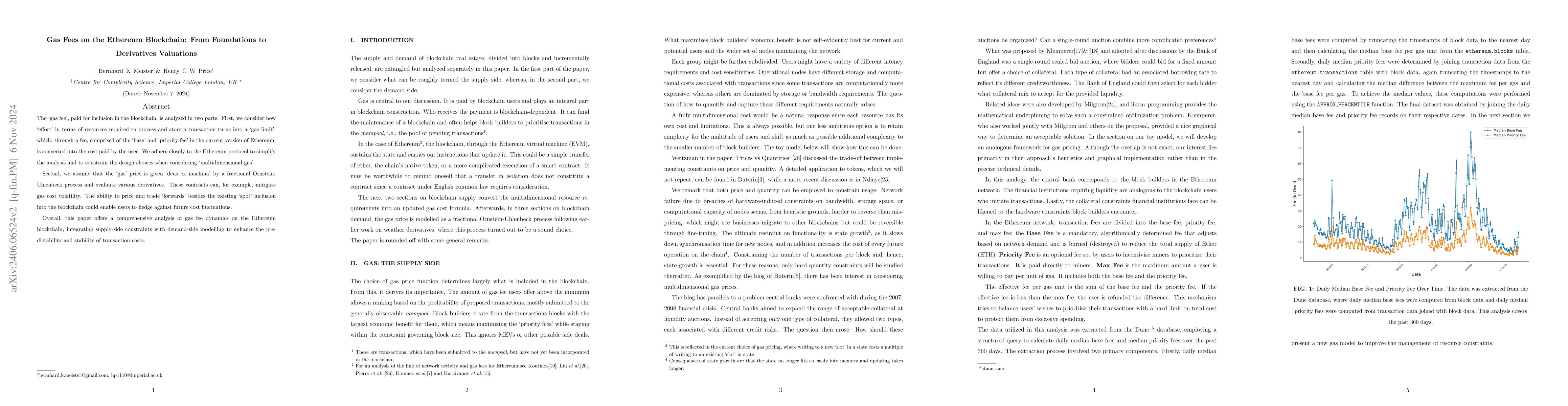

The gas fee, paid for inclusion in the blockchain, is analyzed in two parts. First, we consider how effort in terms of resources required to process and store a transaction turns into a gas limit, which, through a fee, comprised of the base and priority fee in the current version of Ethereum, is converted into the cost paid by the user. We hew closely to the Ethereum protocol to simplify the analysis and to constrain the design choices when considering multidimensional gas. Second, we assume that the gas price is given deus ex machina by a fractional Ornstein-Uhlenbeck process and evaluate various derivatives. These contracts can, for example, mitigate gas cost volatility. The ability to price and trade forwards besides the existing spot inclusion into the blockchain could be beneficial.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime-Varying Bidirectional Causal Relationships Between Transaction Fees and Economic Activity of Subsystems Utilizing the Ethereum Blockchain Network

Lennart Ante, Aman Saggu

Pattern matching algorithms in Blockchain for network fees reduction

Robert Susik, Robert Nowotniak

How to Save My Gas Fees: Understanding and Detecting Real-world Gas Issues in Solidity Programs

Shihao Xia, Yiying Zhang, Nobuko Yoshida et al.

Identifying Likely-Reputable Blockchain Projects on Ethereum

Josef Bajada, Joshua Ellul, Cyrus Malik

| Title | Authors | Year | Actions |

|---|

Comments (0)