Summary

In this paper we treat a gas storage valuation problem as a Markov Decision Process. As opposed to existing literature we model the gas price process as a regime-switching model. Such a model has shown to fit market data quite well in Chen and Forsyth (2010). Before we apply a numerical algorithm to solve the problem, we first identify the structure of the optimal injection and withdraw policy. This part extends results in Secomandi (2010). Knowing the structure reduces the complexity of the involved recursion in the algorithms by one variable. We explain the usage and implementation of two algorithms: A Multinomial-Tree Algorithm and a Least-Square Monte Carlo Algorithm. Both algorithms are shown to work for the regime-switching extension. In a numerical study we compare these two algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

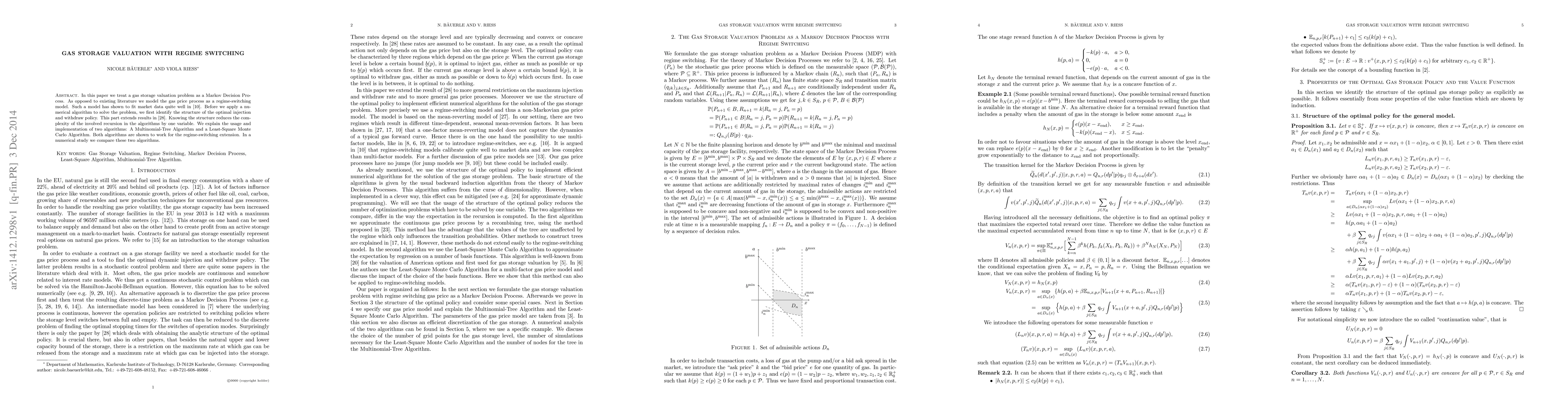

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)