Summary

In a discrete-time financial market, a generalized duality is established for model-free superhedging, given marginal distributions of the underlying asset. Contrary to prior studies, we do not require contingent claims to be upper semicontinuous, allowing for upper semi-analytic ones. The generalized duality stipulates an extended version of risk-neutral pricing. To compute the model-free superhedging price, one needs to find the supremum of expected values of a contingent claim, evaluated not directly under martingale (risk-neutral) measures, but along sequences of measures that converge, in an appropriate sense, to martingale ones. To derive the main result, we first establish a portfolio-constrained duality for upper semi-analytic contingent claims, relying on Choquet's capacitability theorem. As we gradually fade out the portfolio constraint, the generalized duality emerges through delicate probabilistic estimations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

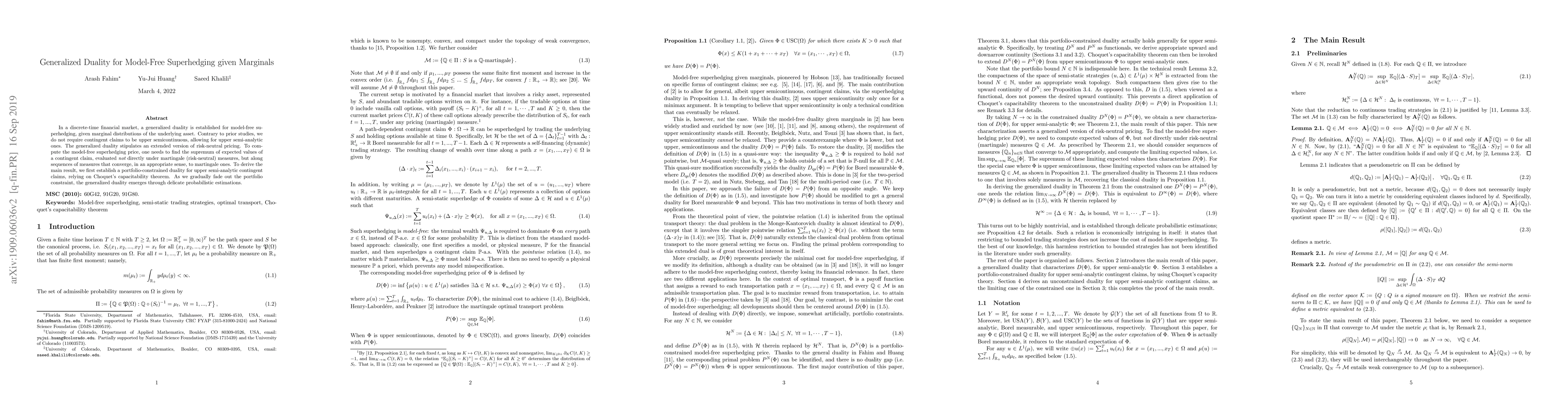

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSuperhedging duality for multi-action options under model uncertainty with information delay

Zhou Zhou, Ivan Guo, Anna Aksamit et al.

No citations found for this paper.

Comments (0)