Authors

Summary

We consider the superhedging price of an exotic option under nondominated model uncertainty in discrete time in which the option buyer chooses some action from an (uncountable) action space at each time step. By introducing an enlarged space we reformulate the superhedging problem for such an exotic option as a problem for a European option, which enables us to prove the pricing-hedging duality. Next, we present a duality result that, when the option buyers action is observed by the seller up to $l$ periods later, the superhedging price equals the model-based price where the option buyer has the power to look into the future for $l$ periods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

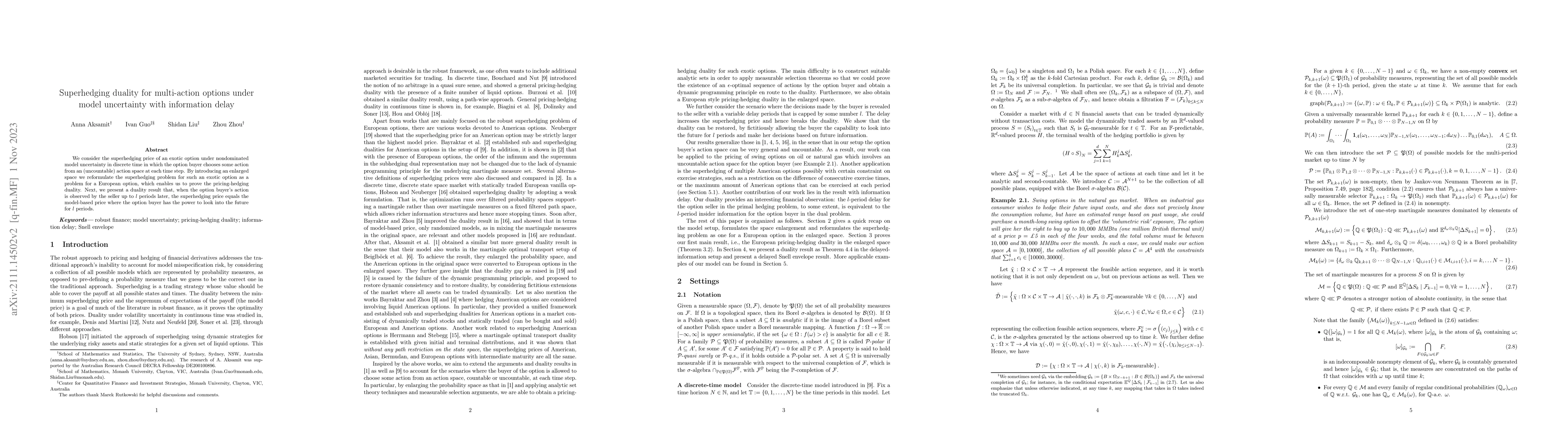

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)