Summary

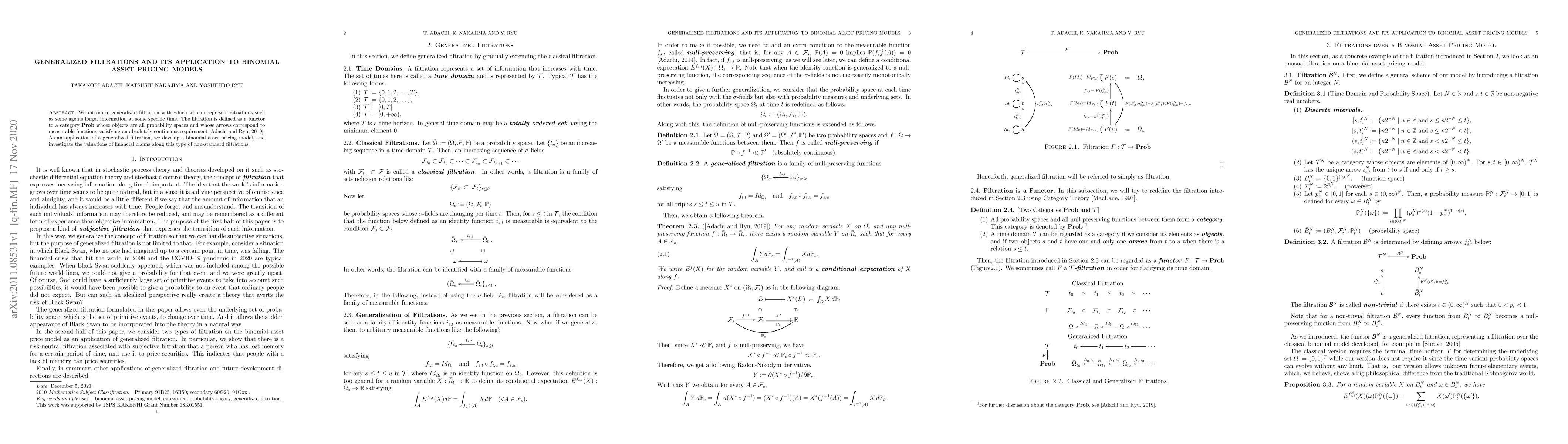

We introduce generalized filtration with which we can represent situations such as some agents forget information at some specific time. The filtration is defined as a functor to a category Prob whose objects are all probability spaces and whose arrows correspond to measurable functions satisfying an absolutely continuous requirement [Adachi and Ryu, 2019]. As an application of a generalized filtration, we develop a binomial asset pricing model, and investigate the valuations of financial claims along this type of non-standard filtrations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA q-binomial extension of the CRR asset pricing model

Nicolas Privault, Jun Fan, Jean-Christophe Breton et al.

No citations found for this paper.

Comments (0)