Summary

In this paper, we generalize the Almgren-Chriss's market impact model to a more realistic and flexible framework and employ it to derive and analyze some aspects of optimal liquidation problem in a security market. We illustrate how a trader's liquidation strategy alters when multiple venues and extra information are brought into the security market and detected by the trader. This study gives some new insights into the relationship between liquidation strategy and market liquidity, and provides a multi-scale approach to the optimal liquidation problem with randomly varying volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

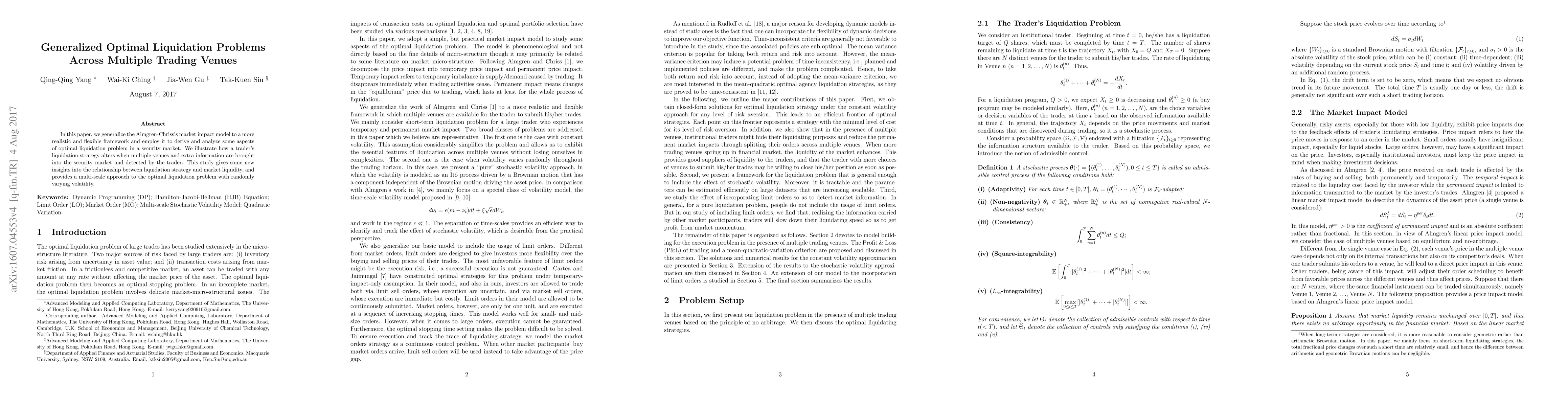

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)