Summary

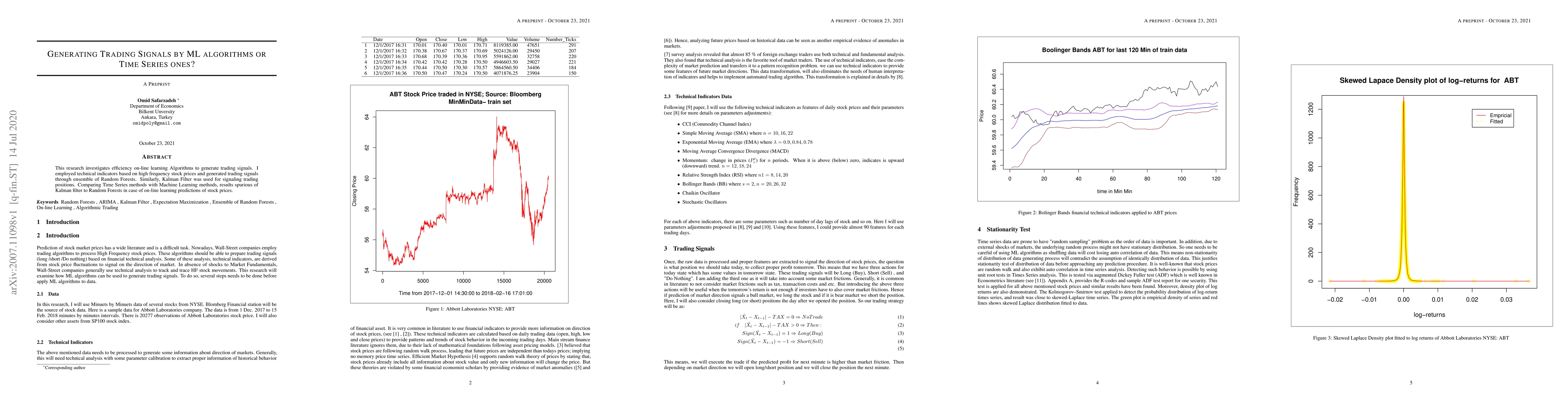

This research investigates efficiency on-line learning Algorithms to generate trading signals.I employed technical indicators based on high frequency stock prices and generated trading signals through ensemble of Random Forests. Similarly, Kalman Filter was used for signaling trading positions. Comparing Time Series methods with Machine Learning methods, results spurious of Kalman Filter to Random Forests in case of on-line learning predictions of stock prices

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA posteriori Trading-inspired Model-free Time Series Segmentation

Mogens Graf Plessen

Applying News and Media Sentiment Analysis for Generating Forex Trading Signals

Oluwafemi F Olaiyapo

No citations found for this paper.

Comments (0)