Authors

Summary

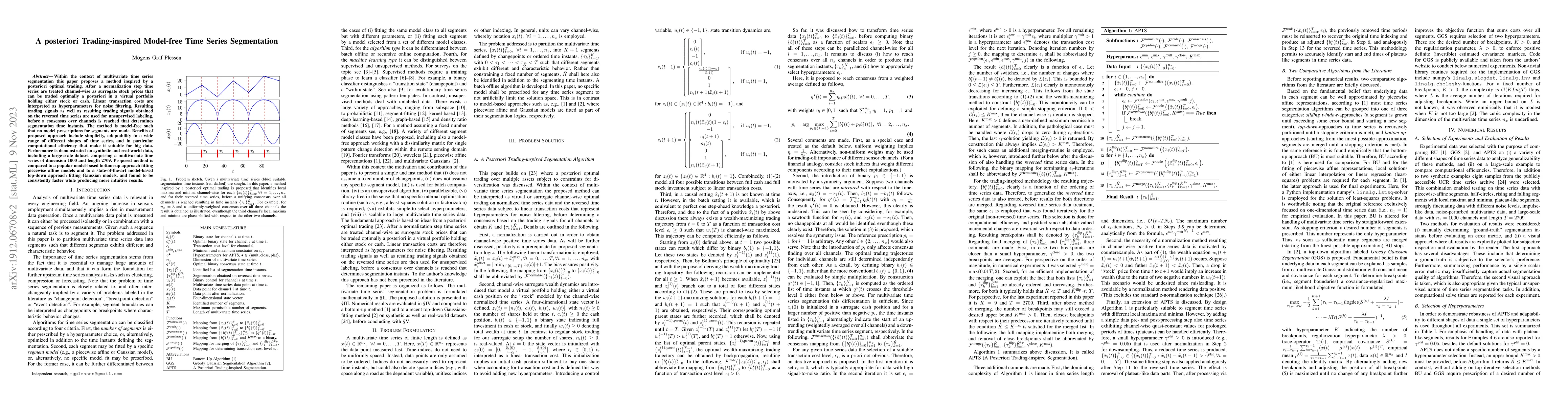

Within the context of multivariate time series segmentation this paper proposes a method inspired by a posteriori optimal trading. After a normalization step time series are treated channel-wise as surrogate stock prices that can be traded optimally a posteriori in a virtual portfolio holding either stock or cash. Linear transaction costs are interpreted as hyperparameters for noise filtering. Resulting trading signals as well as resulting trading signals obtained on the reversed time series are used for unsupervised labeling, before a consensus over channels is reached that determines segmentation time instants. The method is model-free such that no model prescriptions for segments are made. Benefits of proposed approach include simplicity, adaptability to a wide range of different shapes of time series, and in particular computational efficiency that make it suitable for big data. Performance is demonstrated on synthetic and real-world data, including a large-scale dataset comprising a multivariate time series of dimension 1000 and length 2709. Proposed method is compared to a popular model-based bottom-up approach fitting piecewise affine models and to a state-of-the-art model-based top-down approach fitting Gaussian models, and found to be consistently faster while producing more intuitive results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)